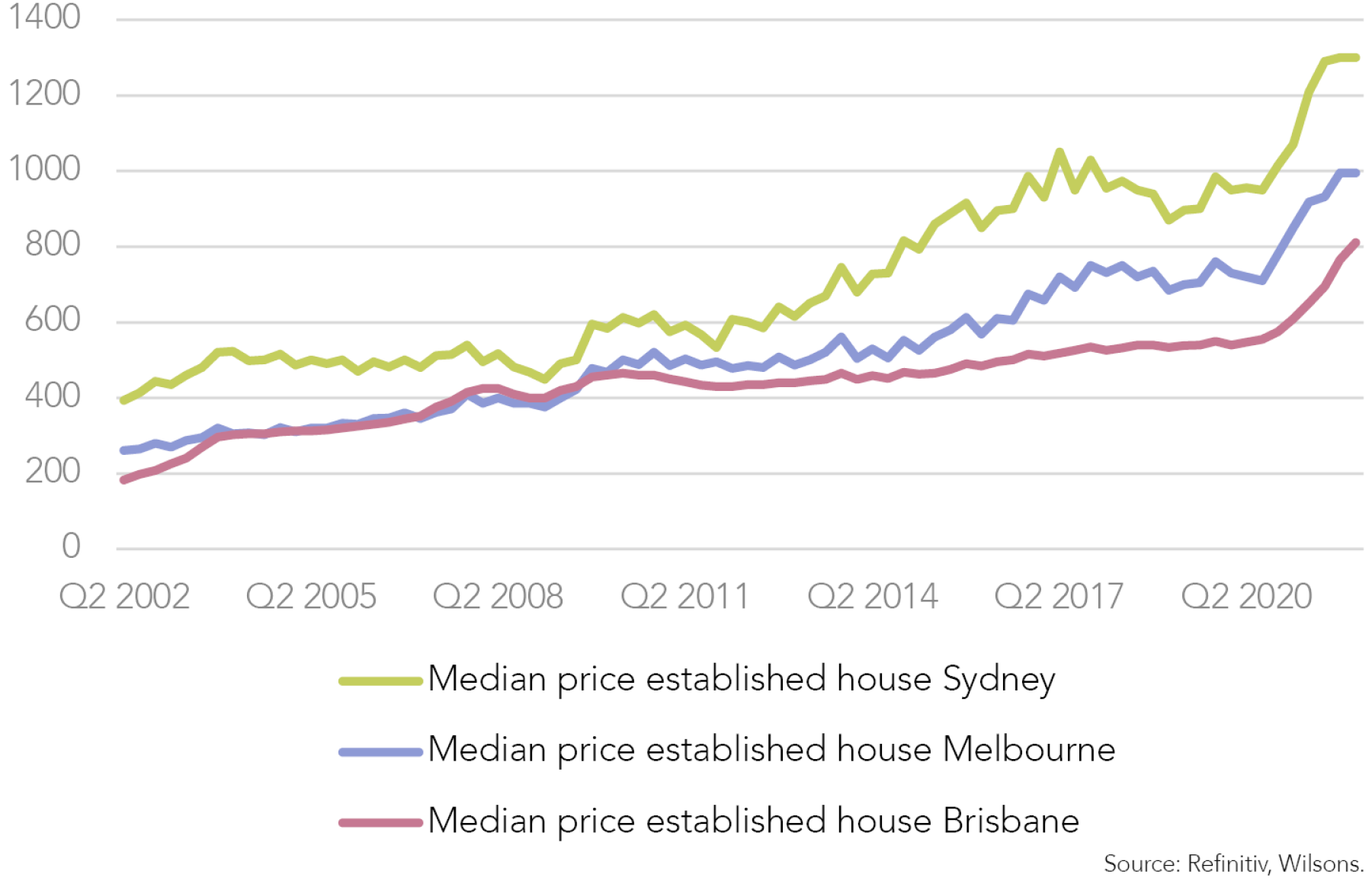

After a 25% national price rise from the 2020 COVID dip, Australian house prices are finally beginning to soften. The national average home price fell 0.1% in May. This is the first monthly decline since September 2020 based on CoreLogic data. The decline was led by falls of 1% in Sydney and 0.7% in Melbourne.

The fact that national home prices are starting to fall after just one 25bp RBA rate rise to a still ultra-low 35bp is interesting but not unexpected. Sydney prices have now fallen for 4 months in a row and Melbourne prices for 3 months. In contrast, Brisbane prices have risen almost 5% in the last 3 months.

An RBA Driven Boom

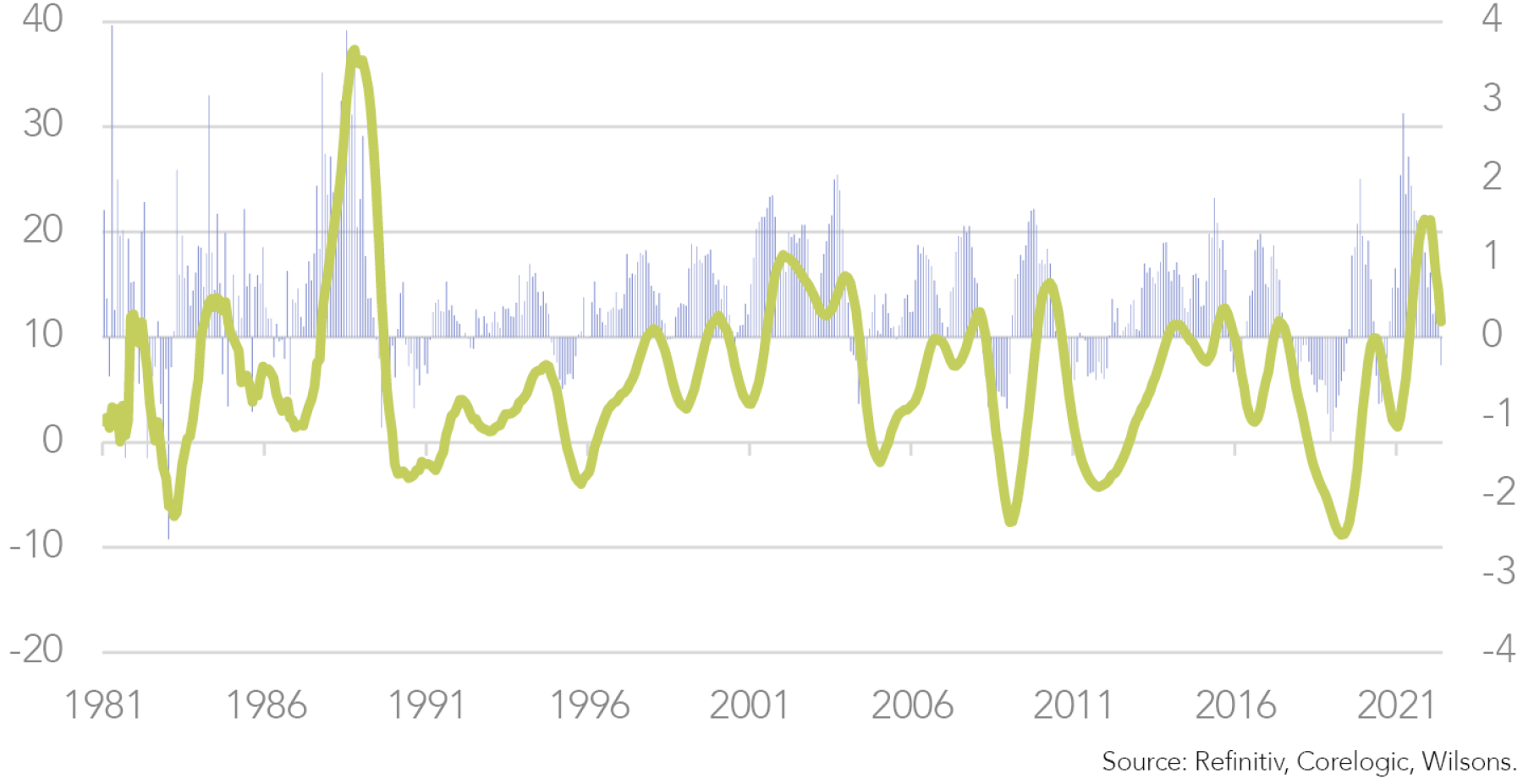

After bottoming in September 2020, residential property prices surged in 2021 to their strongest 12-month gain since 1988. Record low mortgage rates (as the RBA drove cash and 3-year bond rates to close to 0) were the dominant driver in our view. However, the strong economic recovery from the lockdowns of 2020 provided the underlying confidence backdrop, while additional government incentives and a lack of houses for sale also likely contributed to the surge in prices. The fact that prices surged with very limited migration also is also noteworthy.

Significant Correction appears likely but “crash” unlikely

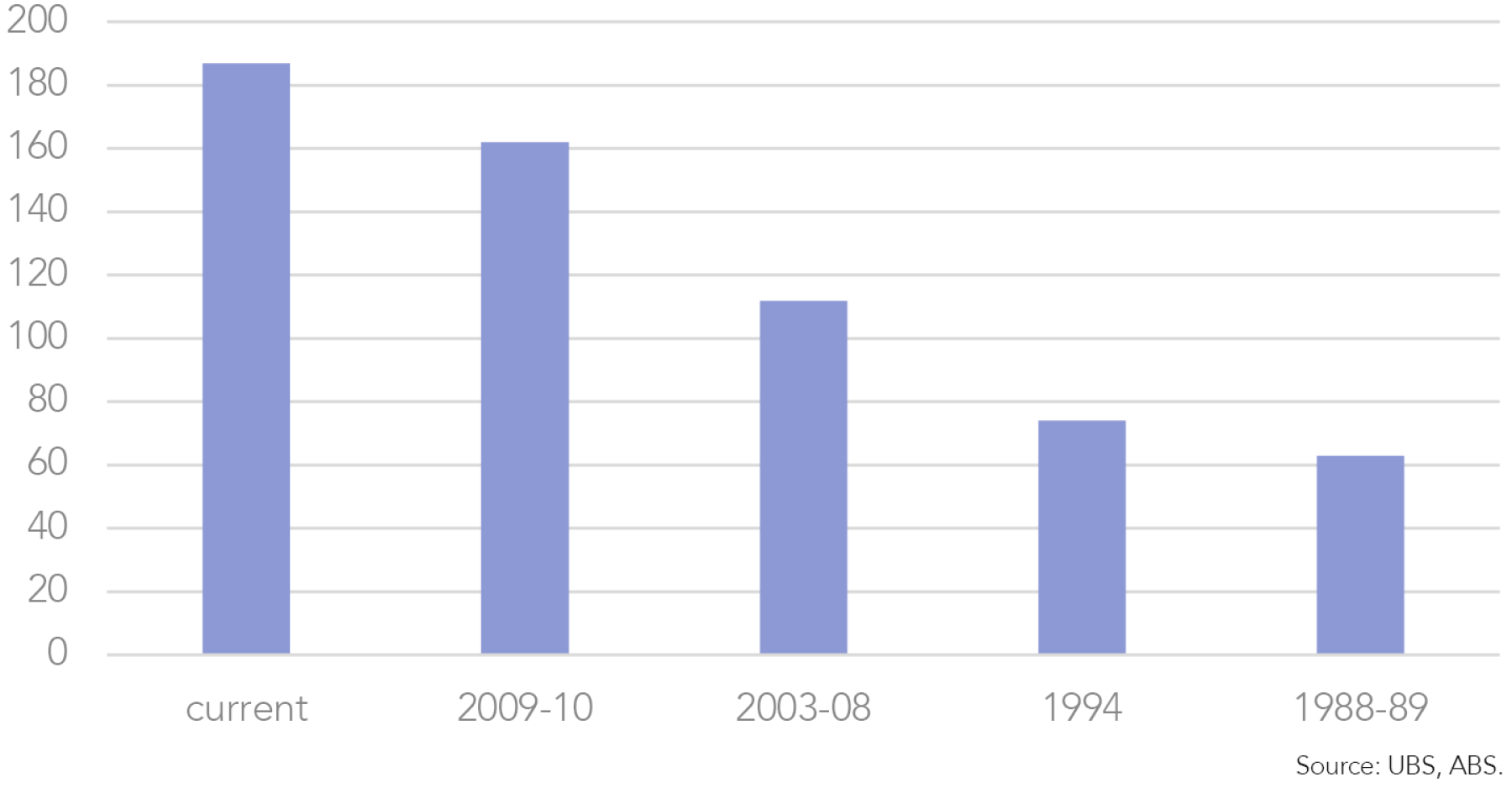

As a base, we expect a 10%-15% fall in home prices with a closer to 20% fall over the next 2 years as a “risk case”. Our base case of reasonably significant falls (by Australian standards) over the next 18 months or so, relates mostly to the impact of the first interest rate hikes in over 11 years coming at a time when household debt to income and house price to income ratios are significantly higher than they were when the last rate hiking cycle started in 2009/10.

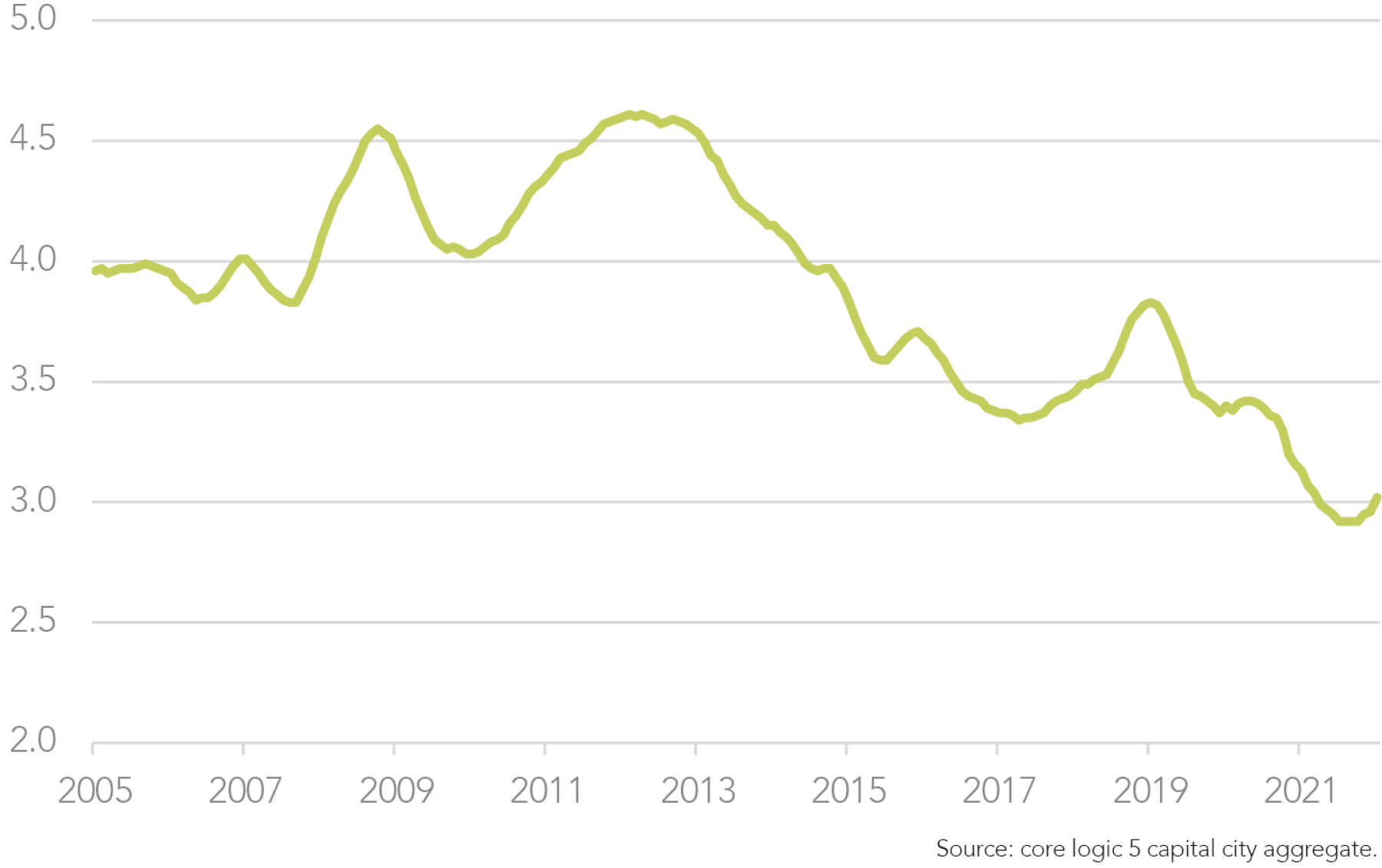

The increase in fixed lending rates and future variable rate rise expectations are the key drivers of the recent softening in our view, while the pace of interest rate hikes hold key to the 12-18-month outlook.

Fixed mortgage rates have more than doubled from around 2% to more than 4% over the past 12 months. The start of RBA monetary tightening, although very mild, has raised homebuyer expectations for a significant rise in variable mortgage rates over the coming year or so. This interest rate effect, alongside the rising cost of living, has led to a decline in home buyer confidence. High house prices themselves are also playing a role with affordability (including the difficulty of accumulating a deposit) deteriorating even before considering further hikes in interest rates.

Being able to borrow at a fixed rate of 2% was a key driver of the surge in prices over the last 18 months or so, with fixed rate lending accounting for ~40% of the flow of loans compared to long run average trends of ~15%. A 'material rate reset' impact will arrive in 2023, as ~¾ of fixed-rate loans expire by the end-23 with 2023 the largest year.

The variable rate outlook, of course, remains very important. The prospect of another ~200 basis points of RBA tightening over the next 12-18 months is likely to pressure house prices for some time.

House price declines likely to start slowly but build into 2023

RBA analysis suggests most households are well ahead on their mortgage payments and have built up significant buffers. The impact on actual mortgage repayments will thus have a longer lag than normal. This is because many borrowers are already currently repaying an amount far above the required minimum repayment schedule. This means the aggregate prepayment buffer (at least for owner-occupier variable rate loans) is much larger than in prior cycles. The RBA estimates that it is at ~21 months now, up from the pre-COVID trend of ~10 months.

While this buffer sounds comforting, as interest rates rise over the coming year, these prepayment buffers will decline quite quickly. The excess buffer flowing into home loan offset accounts is likely to be consumed in 2023 as interest costs ~double over the next 12-18 months.

RBA Policy and the House Price Feedback Loop

While not officially part of its mandate, the RBA will be quite attuned to the impact of their rate rise cycle on house prices. The negative wealth effect from falling home prices will limit how much the RBA ends up raising rates by. They will not want to crash house prices over the next 18 months (20% or greater) and cause an economic recession.

Just how far the RBA ultimately raises the cash rate is open to debate. The RBA has suggested 2.5% is their best estimate of the neutral cash rate. The futures market pricing is suggesting cash rates will rise to 3.5% next year. This implies variable rate mortgages will move up about 350 basis points from their record lows back at 2011 levels.

While mortgages are theoretically stress tested (by the banks) for a rise of between 2.5% to (more recently) 3%, we see this as a level that would place too much stress on mortgage holders, house prices and the economy. Our own estimate of the neutral rate is around 2%. Some market commentators put it as low as 1.5%, which appears to be based on where rates settled in the previous pre COVID cycle.

So, there is a fair degree of uncertainty around the peak cash rate stemming from not just the path of inflation but also the path of house prices. However, under any of these cash rate scenarios, we still have significant tightening to come over the next 12-18 months which should drag house prices (at least 10%) lower. We expect the RBA to be measured enough in its tightening cycle to avoid a greater than 15% correction, albeit we cannot rule out the risk of a larger fall given the imprecise lags in monetary policy impacts.

The End of the Secular Boom

Our central case is for an orderly correction without a material default problem aided by ongoing low unemployment. This would suggest mortgage lending is not likely to be a significant problem for the banking sector over the next 12-18 months. However, risks do appear higher in this particular cycle given starting point gearing levels.

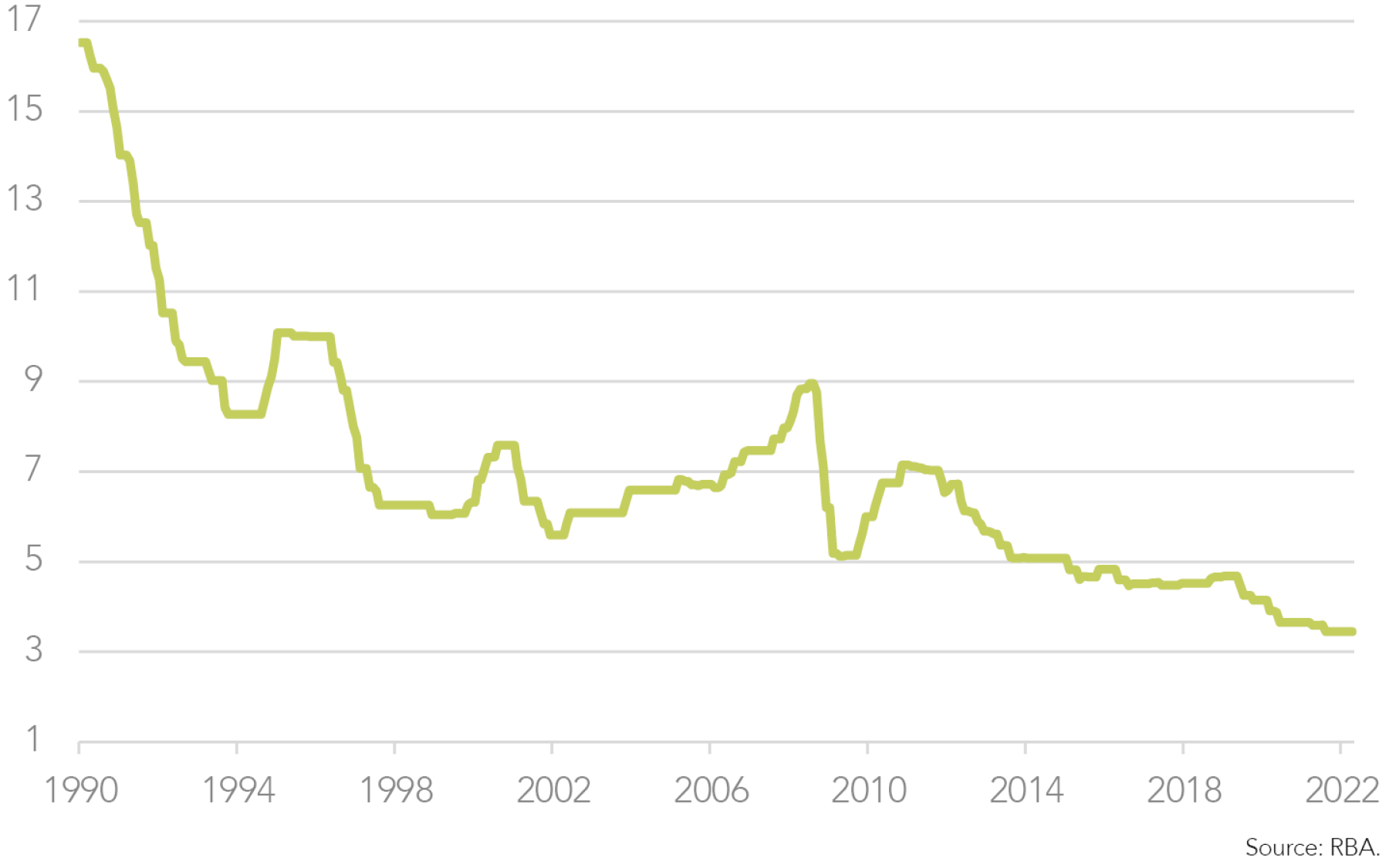

In terms of the longer-term outlook for house prices, we note that the close to 40-year bull market in property prices - with price gains way ahead of CPI and wage inflation - will likely fade in the years ahead even beyond our expected “cyclical downturn”.

The secular decline in mortgage rates, which has enabled new buyers to progressively borrow more and more and hence pay more and more for property, is now likely over. Renewed migration flows and pent up demand from currently locked out potential homebuyers may ultimately provide renewed support for housing over the longer-term; however, longer-term gains should be much more moderate. Nearer term, we think the interest rate cycle will dictate the direction of house prices for the next 18 months at least.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons: Wilsons is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons contains a financial product advice, it is general advice only and has been prepared by Wilsons without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons’ Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons’ disclosures at www.wilsonsadvisory.com.au/disclosures.