Stocks sold off sharply last week as central banks around the world joined a global rush to raise interest rates.

Key central banks have telegraphed their intentions to lift interest rates to tame high inflation. Investors are concerned about the impact on economic growth, which already looks to be slowing. As we have discussed, the risk of recession has increased over the past month, becoming one of the key risks for equity markets.

We think that risks are likely to stay elevated as the market becomes more concerned about the growth outlook as the US Fed and RBA hike rates at a lightning pace over the next 3 months.

To counter this above-trend volatility we think it is prudent to balance the risk/return profile of the Focus List as uncertainty continues to bite.

We have removed Silk Laser (SLA) from the Focus List and trimmed our positions in Pinnacle (PNI) and Judo Bank (JDO).

However, we implore investors not to get too bearish as we believe global inflation (led by the US) and recession risks should fade over the next 6 months.

We also believe “value” is emerging in some quality names post the recent sell-off. We believe quality can outperform over the long run and should generate even better relative returns if bought at a reasonable price. We recently set out our case to add quality defensives here:

We screened the ASX 300 and found a dozen names of quality stocks that look “value”. Our preference is Cleanaway Waste Management (CWY) which we have added to the portfolio at a 3% weighting. We have also increased our weighting to CSL (CSL) +1% and Telstra (TLS) +1%.

Recession Risk Rings Again

Last week the recession risk intensified as a key leading indicator. The US yield curve once again inverted (briefly intraday) and remained close to inversion for the majority of the week. Although the Australian yield curve has remained relatively steep, we believe that ultimately the position of the US economy will be a key driver of global equities (including Australia) over the next 6-12 months. We could be in a position where the US yield curve continues to flirt with inverting over the next few months, sparking volatility in the US and Australian equity markets.

As this volatility continues we think balancing the risk and return in portfolios is imperative to protect capital. We have therefore removed SLA from the Focus List and trimmed our positions in PNI and JDO.

Do not get too bearish

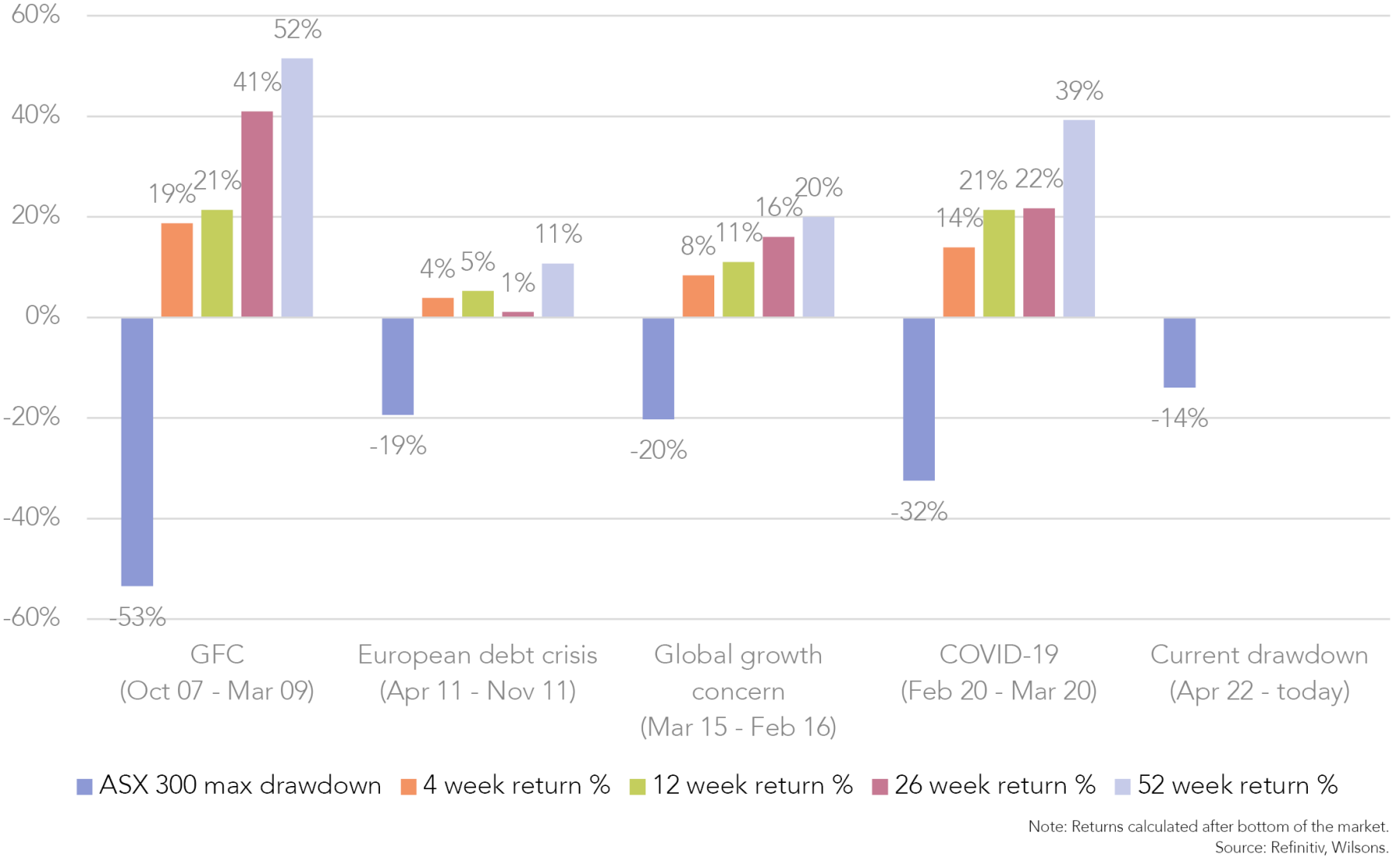

Market declines can be disconcerting, prompting some investors to reduce their stock holdings or exit the market. In the past, financial markets have recovered from market shocks posting strong long-term gains—investors who sell out during a crisis lock in losses and may miss the rebound.

While we are taking some volatility out of the portfolio, we don’t want to overreact to the selloff. The first bounce after a selloff can contain a large part of the returns; riding out the market decline and benefiting from potential rebounds may be the best plan.

We are not by any means saying the selloff is entirely over. However, it is worthwhile to leave some risk on the table. We believe there is a good chance that, despite a likely slowdown in growth, inflation (driven by the US) will start to ease, reducing the need for such sharp central bank tightening and reducing the risk of global recession (which we believe is still the case). This could spark a rebound in equities.

Screening for Oversold Quality

During the recent sell-off and general weakness since the beginning of the year we have screened for opportunities in stocks that look oversold and good opportunities to add to portfolios.

We screened the ASX 300, filtering by:

- Market Cap above A$2bn

- Beta below 1.5

- Positive EPS CAGR Growth

- MTD price change less than -10%

- ISG qualitative overlay

From the screen, we believe Cleanaway (CWY) looks like an opportunity to add quality defensive to the portfolio at a reasonable price.

| Company | Sector GICs | Ticker | Beta | ROE % (FY23) | EPS Growth CAGR (FY1-FY3) | 12mth fwd PE | Price Change MTD % | EPS FY2 Revisions % (90 days) | Comment |

| Cyclical Value | |||||||||

| LendLease | Real Estate | LLC | 1.48 | 6.5 | 67% | 14.7 | -15.3 | -0.8 | Structural story remains intact - moving towards funds under management structure. Construction arm is a risk. |

| Qantas Airways | Industrials | QAN | 1.42 | 30 | 1% | 11.4 | -20.9 | 10.6 | Reopenning still provides a strong earnings story. Risks on recession weighing on stock, but still believe reopening outweighs downturn risk. |

| Defensive | |||||||||

| Cleanaway Waste Management | Industrials | CWY | 1.32 | 7.2 | 25% | 27.3 | -11.7 | -3.7 | Quality defensive, with resilient revenues based off long term contracts. Should be able to continue to grow earnings over the medium-term. |

| Quality Cyclical | |||||||||

| Macquarie Group | Financials | MQG | 1.48 | 14 | 4% | 14.7 | -14.1 | -0.7 | Great structural story that is still intact. Has a cyclical element to its earnings but should continue to exectute on growth over the medium-term. |

| REITS | |||||||||

| Dexus | Real Estate | DXS | 0.89 | 5.5 | 0% | 12.1 | -14.4 | 0.3 | Some REITs look oversold. Earnings have not seen signficant downgrades yet stocks have pulled back a long way. |

| Goodman Group | Real Estate | GMG | 1 | 11.8 | 13% | 18.3 | -16.7 | 1.4 | Great structural story that is still intact. Looks oversold. A Focus List holding. |

| GPT Group | Real Estate | GPT | 1.21 | 5.1 | 3% | 12.6 | -15 | -1.4 | Some REITs look oversold. Earnings have not seen signficant downgrades yet stocks have pulled back a long way. |

| National Storage REIT | Real Estate | NSR | 0.89 | 4.6 | 4% | 19.9 | -12 | -0.6 | Some REITs look oversold. Earnings have not seen signficant downgrades yet stocks have pulled back a long way. |

| Resources | |||||||||

| IGO | Materials | IGO | 1.3 | 30.9 | 57% | 6.7 | -16.1 | 37.2 | EV minerals should outperform other resources in a downturn as demand is likely to accerlerate even in a downturn. |

| Lynas Rare Earths | Materials | LYC | 1.05 | 30.8 | 7% | 12.6 | -12.1 | -2 | EV minerals should outperform other resources in a downturn as demand is likely to accerlerate even in a downturn. |

| Structural Growth | |||||||||

| ALS | Industrials | ALQ | 1.35 | 26 | 7% | 17.5 | -14.6 | 6 | Great structural story that is still intact. Has a cyclical element to its earnings but should continue to exectute on growth over the medium-term. |

| Domino's Pizza | Consumer Discretionary | DMP | 0.61 | 45.5 | 19% | 25.4 | -11.9 | -6 | Stock has fallen heavily, earnings now seem to account for earnings slowdown post-COVID. |

Source: Refinitiv, Wilsons.

Adding Cleanaway (CWY)

What does CWY do?

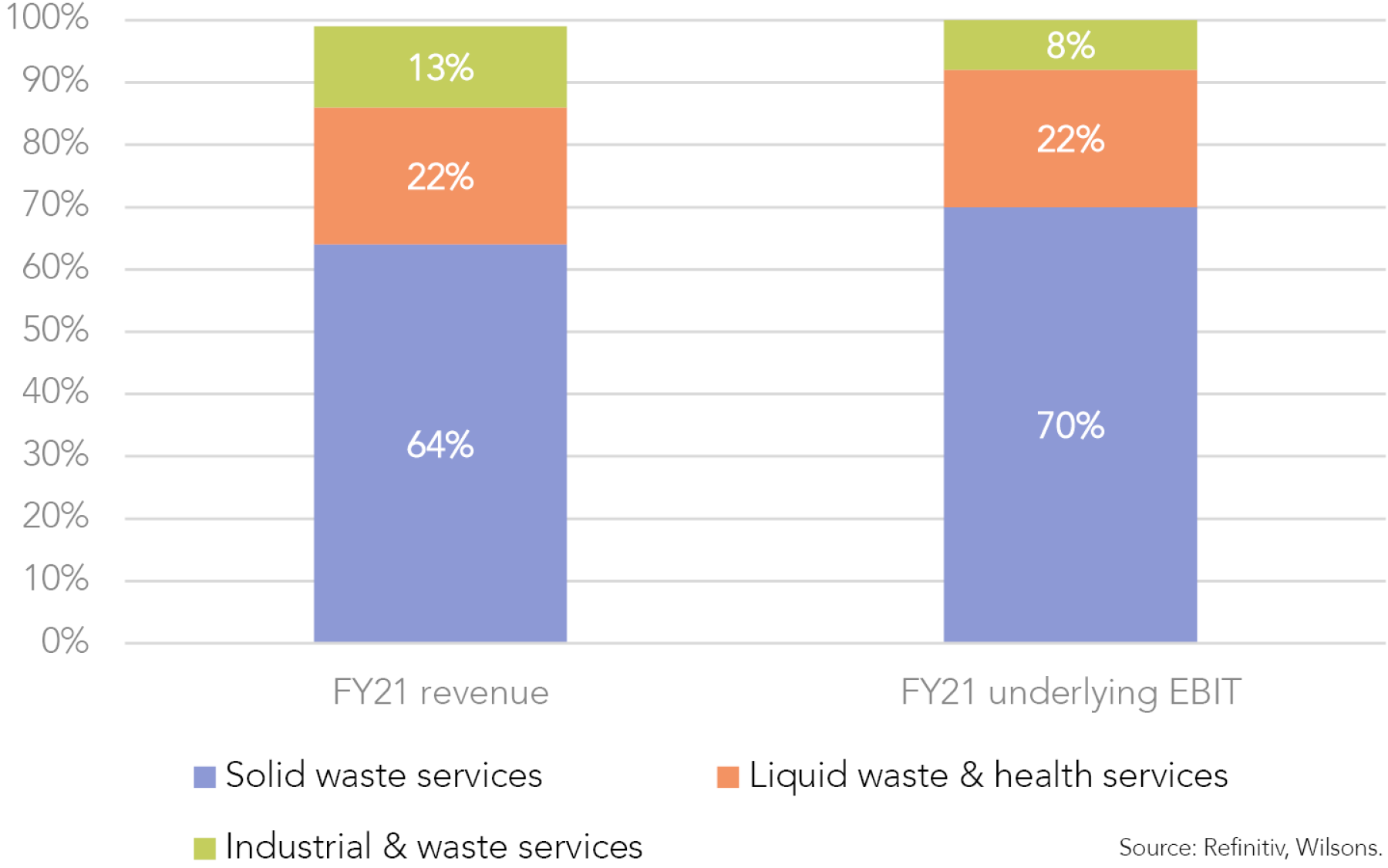

Cleanaway is a leading waste management services company in Australia. Cleanaway is vertically integrated through the waste value chain from waste collection to resource and energy recovery, to waste treatment and landfill.

CWY is a quality defensive

Quality earnings growth with defensive characteristics

The majority of CWY’s revenue is contracted and therefore recurring. Cleanaway’s revenue is largely underpinned by long-term contracts across different waste categories with a geographically diverse customer base of municipal councils, hospitals, infrastructure, resources, and commercial/industrial clients.

Multi-year contracts provide steady volumes and recurring revenues and include appropriate price adjustment mechanisms. For example, the largest proportion of revenue from solid waste services, the duration of Municipal contracts is typically 7-10 years and 3+ years for commercial and industrial contracts.

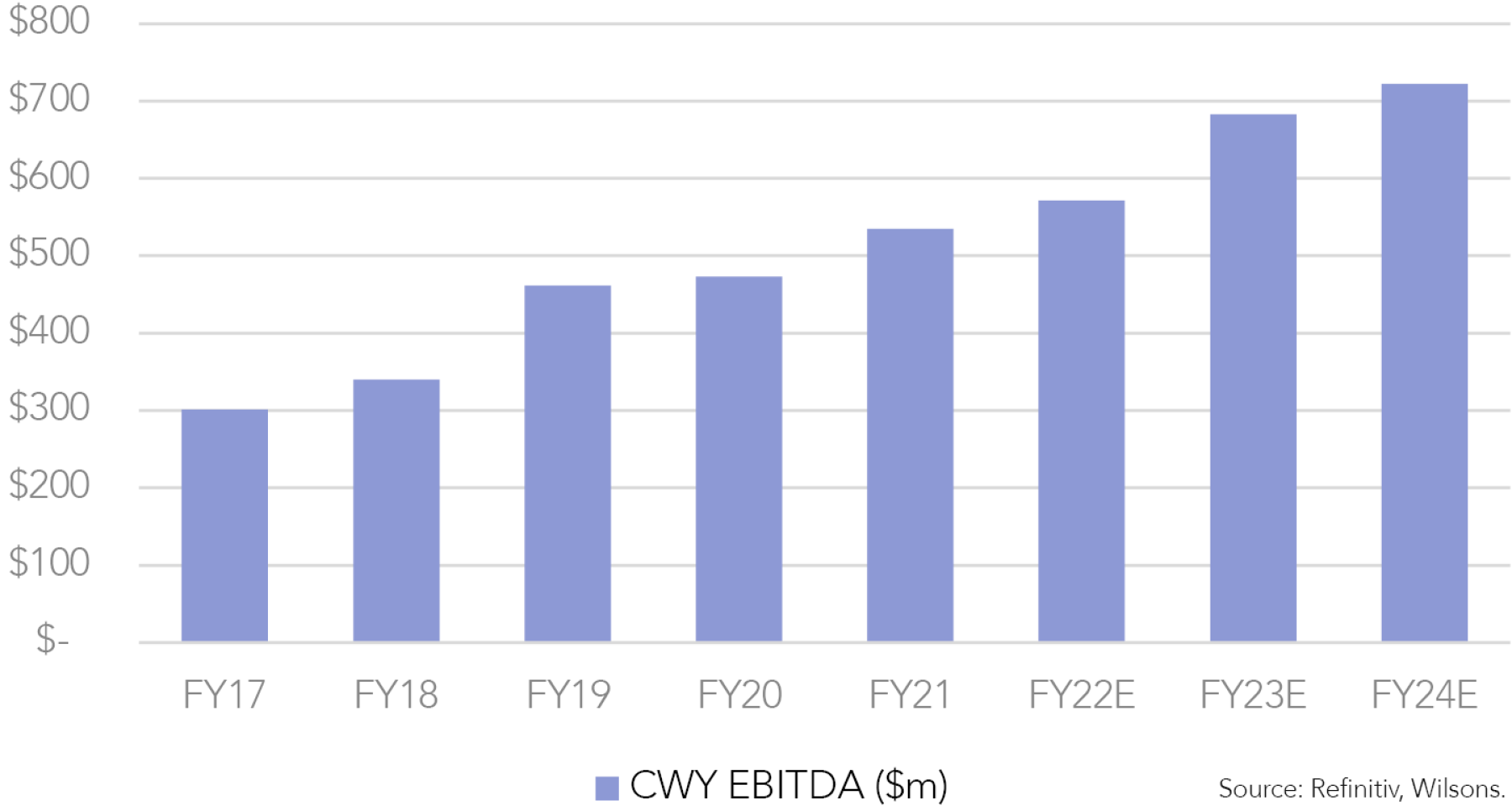

Management has found ways to optimise revenue over this period. Underlying earnings have grown since 2015, coupled with steady margin improvement.

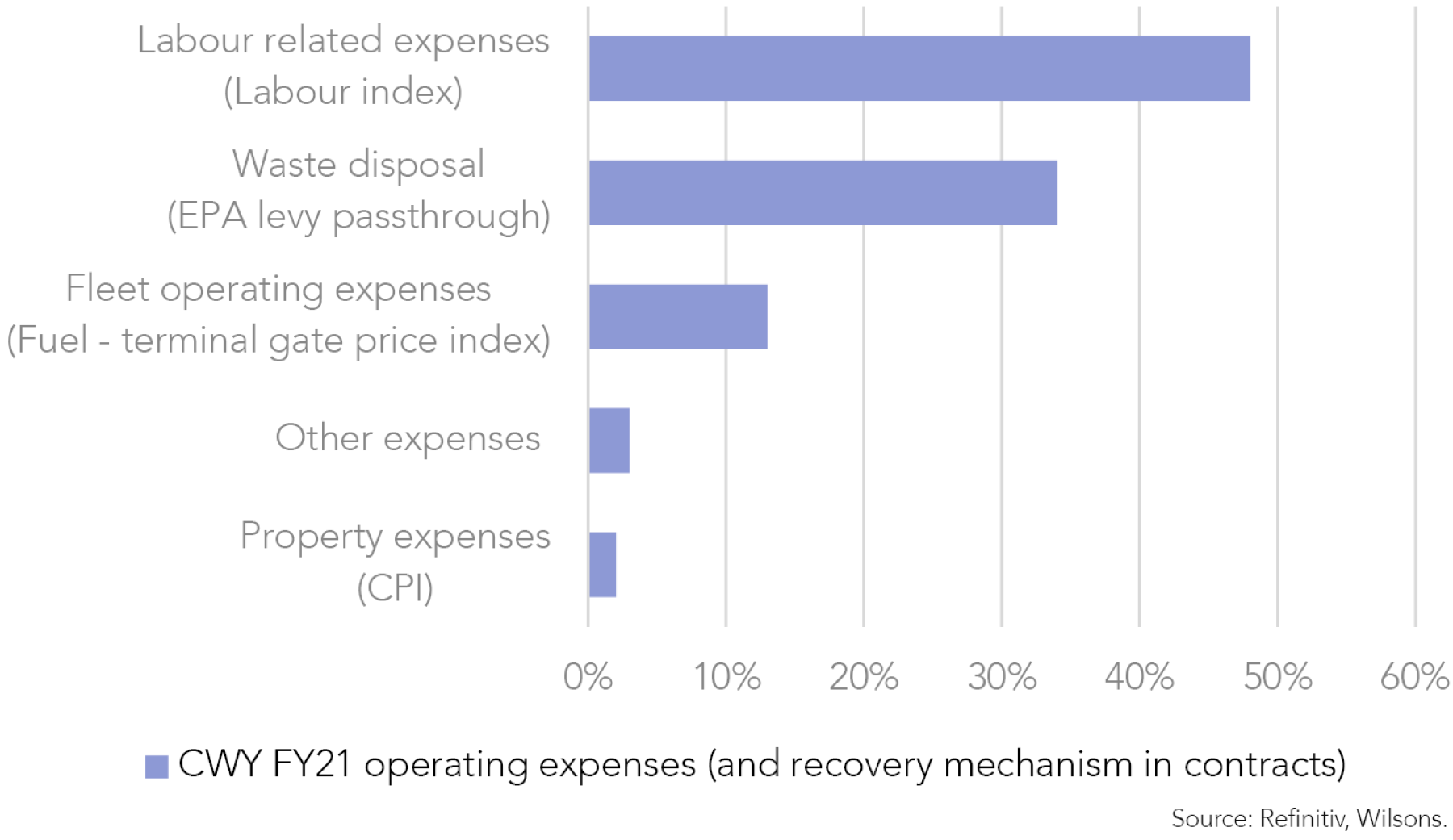

Inflation protection

CWY is largely insulated from inflationary pressure with contract pass through mechanisms. The key costs for CWY are labour, waste disposal and fleet costs (fuel, repair and maintenance etc). Rise and fall clauses in contracts capture relevant labour fuel and general CPI changes. However, price adjustments tend to be lagged as they adjust on the contract anniversary date or 1st July.

Market-leading position with barriers to entry

CWY is Australia’s leading waste management company. This puts CWY in a strong position for contract wins and negotiations.

CWY is vertically integrated across the waste value chain. A strong nationwide portfolio of infrastructure assets, including treatment and landfill, provides synergies between operating upstream (collection) and downstream (treatment and landfill). The recently acquired landfill and transfer stations from Suez are likely to increase margins, since they complement CWY's collections operations and enable significant

waste internalisation (collection and disposal synergies).

The capital intensity, engineering and regulatory licensing and approvals are barriers to entry for competition trying to enter downstream. It is very difficult to build new landfill sites in Australia.

Short-term disruption now priced in

While CWY has quality defensive assets, it is not impervious to disruption. A combination of recent one-off operational issues (flood impact on New Chum landfill - 5-7m EBITDA and equipment damage in Health Services post-collection - 5-7m EBITDA impact) and labour availability and costs led to management downgrading guidance for 2H22.

These issues are largely one-offs, and contract levers will pass costs onto customers. This disruption now looks to be overdone with respect to the share price.

Ability to compound earnings growth

Margin expansion

We still believe CWY can grow earnings over the next 2 years. CWY has set a 29-29.5% EBITDA margin target for its Solid Waste segment. We think CWY can surpass this target as it generates synergies from recent acquisitions, particularly the Suez acquisition, and earnings optimisation that CWY management has been executing on for a number of years. We believe if CWY can achieve a 30% EBITDA margin this will be above consensus for FY24.

M&A

CWY has a proven track record of successful bolt-on acquisitions, seamlessly incorporating these assets into the business. We still believe that CWY can find further targets over the next few years to provide value for shareholders and grow earnings.

Long-term earnings growth

Longer-term drivers of CWY include:

- FOGO (food/garden organics): The fastest growing segment due to the implementation of recycling policies by local governments.

- Construction and demolition (C&D) waste: CWY has traditionally focused on municipal and construction and improvement (C&I) waste, but it sees opportunities to expand into the faster growing C&D market. This segment is more cyclical, but it feels it can be absorbed within its broader portfolio.

- Waste-to-Energy (WtE): The largest investment opportunity by project, but long-term (commissioning in 5-6 years). WtE uses residual waste otherwise destined for landfill to generate electricity.

Valuation

CWY trades on a 12-month forward PE of 27x. We think this is a reasonable multiple for a quality defensive in a market-leading position, with long-term contracts insulated from inflationary pressures. This multiple also looks reasonable relative to the 25% growth expected over the next few years for CWY.

Other Focus List Changes

Removing Silk Laser (SLA) -2%

We still like the SLA story and think it is a reopening trade, but the stock has become too small and illiquid to hold in the portfolio (market cap around $100m). Furthermore, the risk of recession is starting to weigh on the stock.

Trimming Judo (JDO) -2%

JDO should continue to grow its book and benefit from higher net interest margins over the next 12 months. However, the growing tail risk of a recession is weighing on the stock and the growth story would be severely disrupted by a downturn in the economy. A stock that we still like and want to hold but reducing our overweight position.

Trimming Pinnacle (PNI) -1%

We are concerned the performance of the biggest affiliates for PNI will lead to fund outflows over the next 6 months. We believe the diversified nature of fund affiliates provides PNI some protection against a downturn, but stock is likely to suffer if sentiment falls further. A stock that we still like and want to hold but reducing our overweight position.

Adding to CSL (CSL) +1% and Telstra (TLS) +1%

Adding to these quality defensive names to move further overweight on CSL and move overweight on Telstra after a fall in the share price.

| Company | Ticker | Beta | ROE % (FY23) | EPS Growth CAGR (FY1-FY3) |

12mth fwd PE | Price Change MTD % | Price Change YTD % | EPS FY2 Revisions % (90 days) | Comment | ISG recommended |

| Banks | ||||||||||

| ANZ | ANZ | 1.19 | 10 | 7% | 9.7 | -15.5 | -23.1 | -2.5 | Banks look interesting after the pull back but concern the RBA is going to push hard on the brake over the next 6 months hurting sentiment. | |

| Bank of Queensland Ltd | BOQ | 1.23 | 8.2 | 2% | 8.6 | -13.7 | -19.9 | 1.4 | Banks look interesting after the pull back but concern the RBA is going to push hard on the brake over the next 6 months hurting sentiment. | |

| Bendigo and Adelaide Bank Ltd | BEN | 1.32 | 7.4 | 3% | 10.7 | -16.7 | -4.6 | 3.4 | Banks look interesting after the pull back but concern the RBA is going to push hard on the brake over the next 6 months hurting sentiment. | |

| Commonwealth Bank of Australia | CBA | 1.04 | 12.4 | 5% | 15.9 | -16.4 | -13.6 | 2.1 | Banks look interesting after the pull back but concern the RBA is going to push hard on the brake over the next 6 months hurting sentiment. | |

| National Australia Bank Ltd | NAB | 1.26 | 12 | 7% | 11.6 | -17.1 | -10.1 | 4 | Banks look interesting after the pull back but concern the RBA is going to push hard on the brake over the next 6 months hurting sentiment. | |

| Westpac Banking Corp | WBC | 1.1 | 9.6 | 17% | 10.6 | -19.6 | -10.1 | 2.4 | Banks look interesting after the pull back but concern the RBA is going to push hard on the brake over the next 6 months hurting sentiment. | |

| Cyclical Value | ||||||||||

| AMP Ltd | AMP | 0.91 | 5.3 | 18% | 13.4 | -10.5 | -3 | -17.9 | Too many structural issues. | |

| LendLease Group | LLC | 1.48 | 6.5 | 67% | 14.7 | -15.3 | -14.7 | -0.8 | Structural story remains intact - moving towards funds under management structure. Construction arm is a risk. | ★ |

| Qantas Airways Ltd | QAN | 1.42 | 30 | 1% | 11.4 | -20.9 | -13 | 10.6 | Reopening still provides a strong earnings story. Risks on recession weighing on stock. | ★ |

| Defensive | ||||||||||

| Ansell Ltd | ANN | 0.8 | 10.3 | 7% | 11 | -22.2 | -32.3 | -1.9 | Concerned on costs over the next 6-12 months. | |

| Cleanaway Waste Management Ltd | CWY | 1.32 | 7.2 | 25% | 27.3 | -11.7 | -15.3 | -3.7 | Quality defensive, with resilient revenues based off long-term contracts. Should be able to continue to grow earnings over the medium-term. | ★ |

| Cochlear Ltd | COH | 0.75 | 16.6 | 13% | 39.6 | -15.2 | -12.6 | -1 | Quality company with competitive advantage but currently limiting our exposure to high multiple stocks. | |

| High Growth | ||||||||||

| WiseTech Global Ltd | WTC | 1.26 | 18.9 | 29% | 54.5 | -14.9 | -38.9 | -0.8 | Quality company with strong structural story but currently limiting our exposure to high multiple stocks. | |

| Xero Ltd | XRO | 1.29 | 5 | 89% | 177.2 | -17.7 | -48 | -9.3 | Focus List holding and we still believe this to be a quality stock with recurring revenues. Current 2% weighting is sufficient in the Focus List. | |

| Quality Cyclical | ||||||||||

| Macquarie Group Ltd | MQG | 1.48 | 14 | 4% | 14.7 | -14.1 | -22.2 | -0.7 | Great structural story that is still intact. Has a cyclical element to its earnings but should continue to exectute on growth over the medium term. | ★ |

| Wesfarmers Ltd | WES | 0.99 | 28.7 | 7% | 19.5 | -12.8 | -30.6 | 0 | Quality company with a strong market position. Still concerned it benefitted from COVID and future earnings do not reflect this. | |

| REITS | ||||||||||

| Charter Hall Long WALE REIT | CLW | 0.65 | 5.1 | 0% | 13.8 | -13.6 | -15.8 | -1.9 | Some REITs look oversold. Earnings have not seen signficant downgrades yet stocks have pulled back a long way. | |

| Dexus | DXS | 0.89 | 5.5 | 0% | 12.1 | -14.4 | -19.3 | 0.3 | Some REITs look oversold. Earnings have not seen signficant downgrades yet stocks have pulled back a long way. | ★ |

| Goodman Group | GMG | 1 | 11.8 | 13% | 18.3 | -16.7 | -35.4 | 1.4 | Great structural story that is still intact. Looks oversold. A Focus List holding. | ★ |

| GPT Group | GPT | 1.21 | 5.1 | 3% | 12.6 | -15 | -24.5 | -1.4 | Some REITs look oversold. Earnings have not seen signficant downgrades yet stocks have pulled back a long way. | ★ |

| National Storage Reit | NSR | 0.89 | 4.6 | 4% | 19.9 | -12 | -20.3 | -0.6 | Some REITs look oversold. Earnings have not seen signficant downgrades yet stocks have pulled back a long way. | ★ |

| Resources | ||||||||||

| IGO Ltd | IGO | 1.3 | 30.9 | 57% | 6.7 | -16.1 | -7.5 | 37.2 | EV minerals should outperform other resources in a downturn as demand is likely to accerlerate even in a downturn. | ★ |

| Lynas Rare Earths Ltd | LYC | 1.05 | 30.8 | 7% | 12.6 | -12.1 | -14.8 | -2 | EV minerals should outperform other resources in a downturn as demand is likely to accerlerate even in a downturn. | ★ |

| Mineral Resources Ltd | MIN | 1.34 | 38.4 | 50% | 6.8 | -18.9 | -7.5 | 72.8 | We like the lithium story in MIN but believe the company is low quality. | |

| Structural Growth | ||||||||||

| A2 Milk Company Ltd | A2M | 0.29 | 10.7 | 22% | 23.9 | -12.9 | -23.4 | -3.5 | Concerned on China's lockdown and lack of travel to consider A2M currently. | |

| ALS Ltd | ALQ | 1.35 | 26 | 7% | 17.5 | -14.6 | -16.5 | 6 | Great structural story that is still intact. Has a cyclical element to its earnings but should continue to exectute on growth over the medium-term. | ★ |

| Altium Ltd | ALU | 1.15 | 22.3 | 25% | 39.4 | -11 | -43.4 | -2.3 | Quality company with strong structural story but avoiding high multiple stocks. | |

| ARB Corp Ltd | ARB | 0.99 | 20.7 | 2% | 17.3 | -19.5 | -50.9 | -4.1 | Quality company with a strong market position. Still concerned it benefitted from COVID and future earnings do not reflect this. | |

| Domino's Pizza Enterprises Ltd | DMP | 0.61 | 45.5 | 19% | 25.4 | -11.9 | -48.6 | -6 | Stock has fallen heavily, earnings now seem to account for earnings slowdown post-COVID. | ★ |

| REA Group Ltd | REA | 1.36 | 32.8 | 14% | 27.1 | -15.4 | -43.2 | -4.1 | Concerned on housing with rising rates. | |

| Reece Ltd | REH | 0.84 | 12.8 | 11% | 20.3 | -16.7 | -50.6 | 0 | Potential for EPS downgrades over the next 6 months. COVID winner. | |

Source: Refinitiv, Wilsons.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons: Wilsons is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons contains a financial product advice, it is general advice only and has been prepared by Wilsons without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons’ Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons’ disclosures at www.wilsonsadvisory.com.au/disclosures.