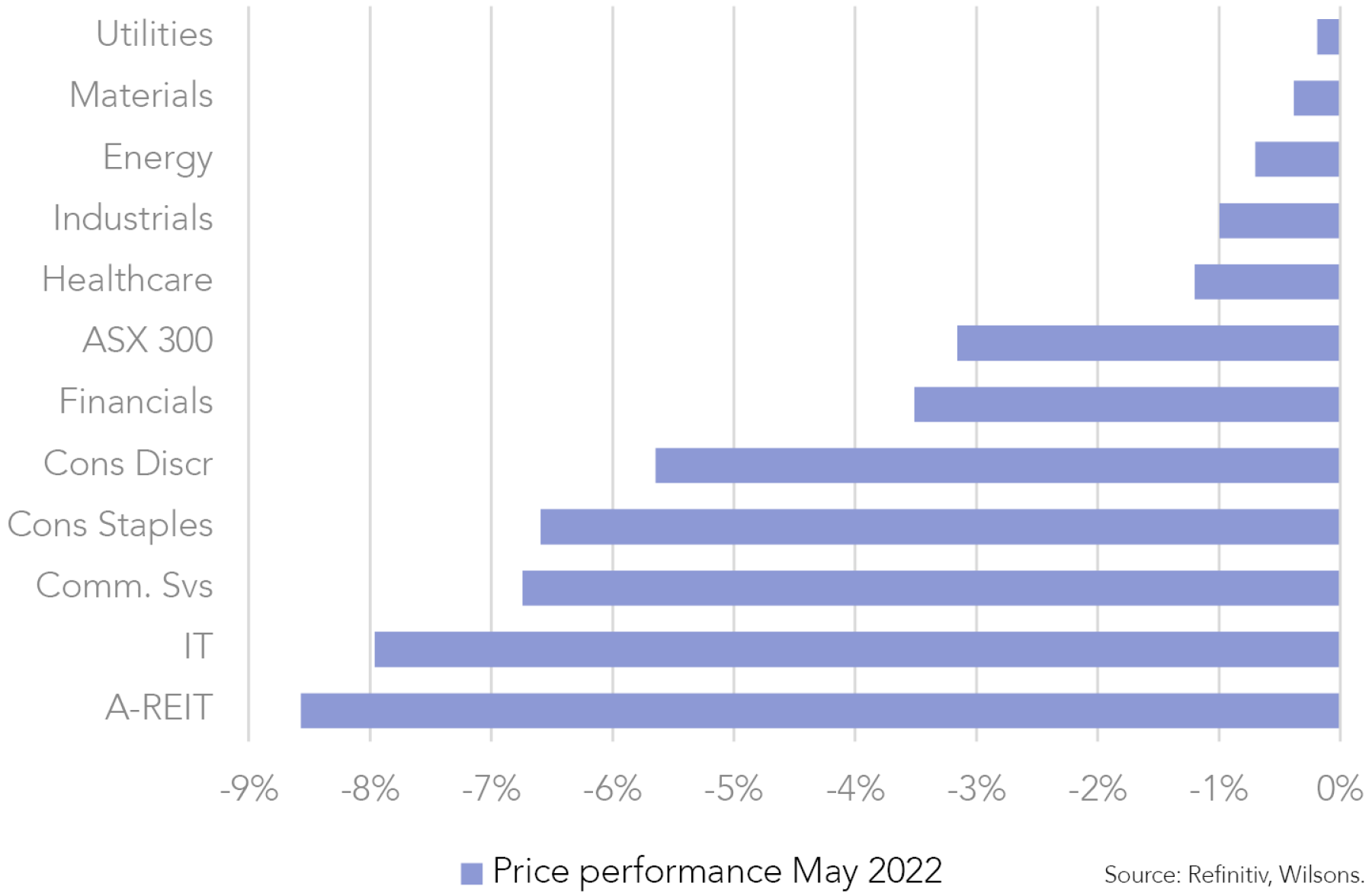

May was a tricky time to be an Australian investor with the market falling 3% over the month, underperforming the MSCI World ex Australia over the same period (-1.1%).

The macro still seems to rule the roost. Inflation remained the market's key concern as inflation pressures proved stubborn, exacerbated by the ongoing war in Ukraine and supply chain issues with lockdowns in China. Growth indicators are still holding up, but higher interest rates throughout the globe (except China) are leading to concern this cycle may be shorter than expected, with recession concerns bubbling up.

Concern around central bank hawkishness eased slightly. However, the outlook for interest rates remains unclear, leading to lingering concern over growth stocks with valuations remaining sensitive to higher bond yields. IT was one of the worst sectors in May, down 8% for the month.

Cyclicals have also not escaped unscathed; the market has become increasingly concerned over whether the US Fed can engineer a soft landing while taming the inflation fire. The US economy is such an important cog in the global economy that a recession will likely be felt globally including Australia.

The typical defensive sectors like utilities and healthcare outperformed in May as market concerns over inflation and growth pushed investors to safe haven equity sectors. We believe a shift towards quality defensives is sensible.

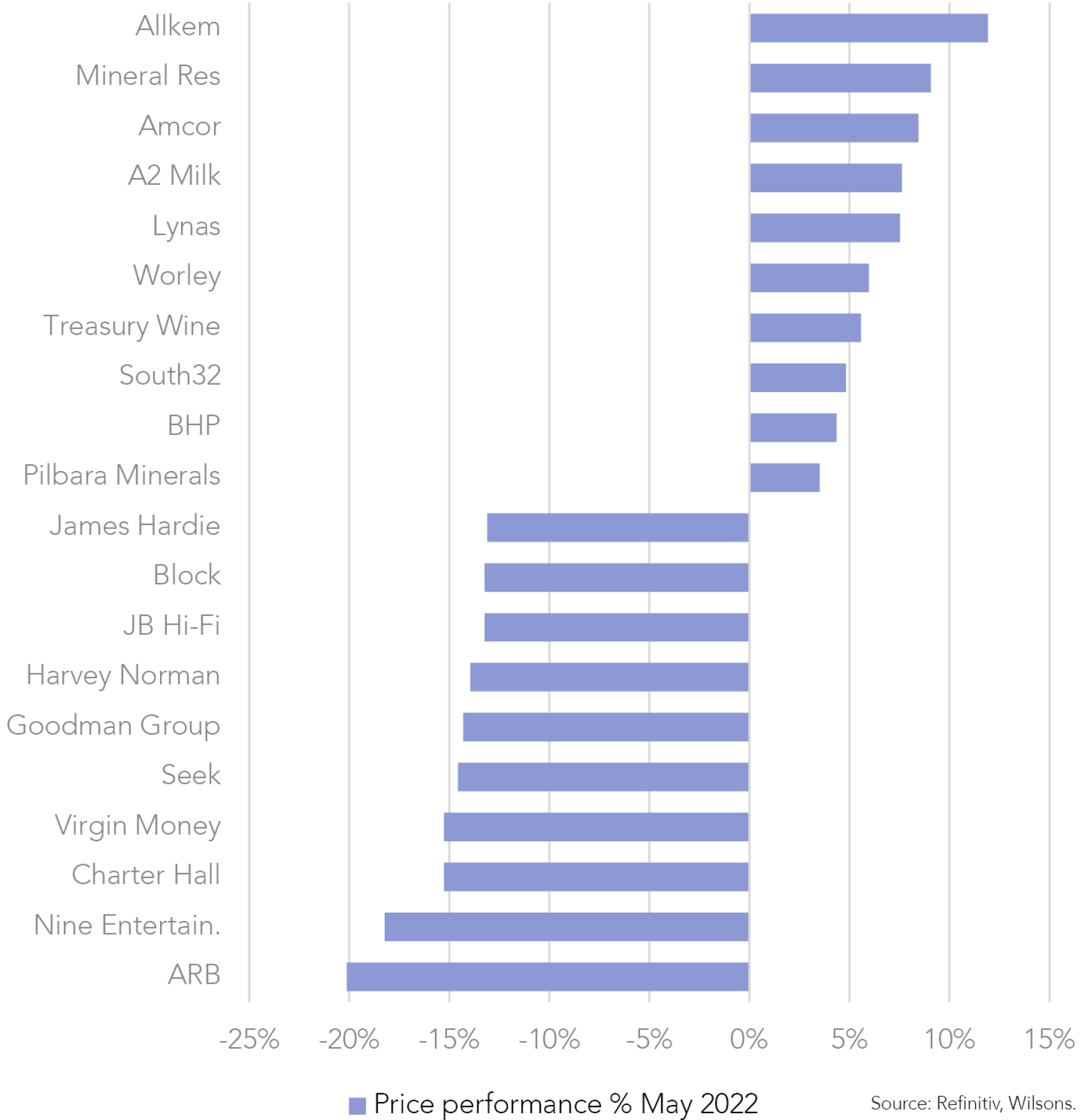

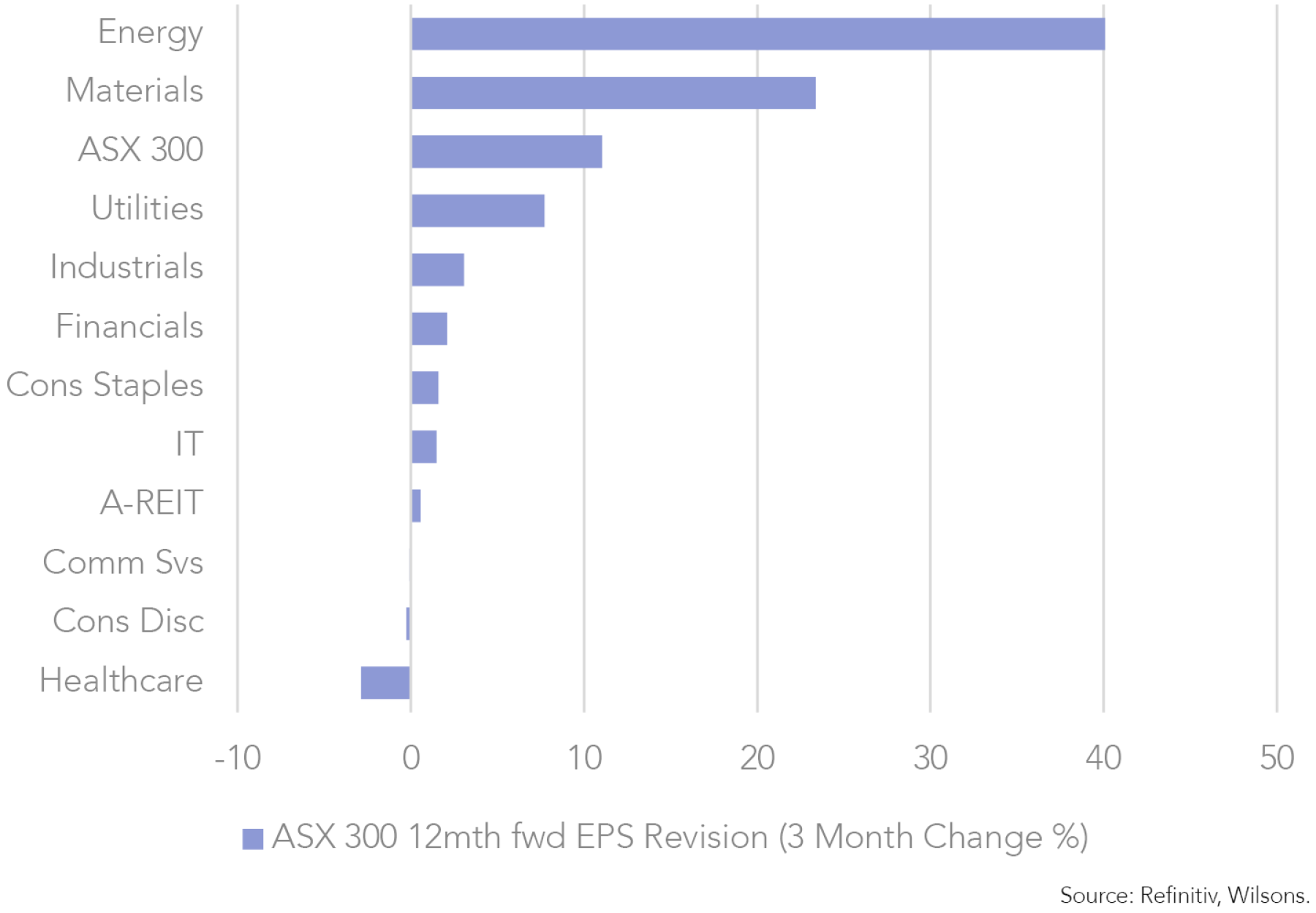

Inflation hedges continued to outperform, with materials and energy also performing strongly. The prospect of an end to China's Covid lockdowns led to a small relief rally in resources (namely iron ore and copper) at the end of the month. Energy continues to be the star sector of the year so far, with a tight market seemingly getting tighter as the Russia/Ukraine conflict persists.

ISG Views for June

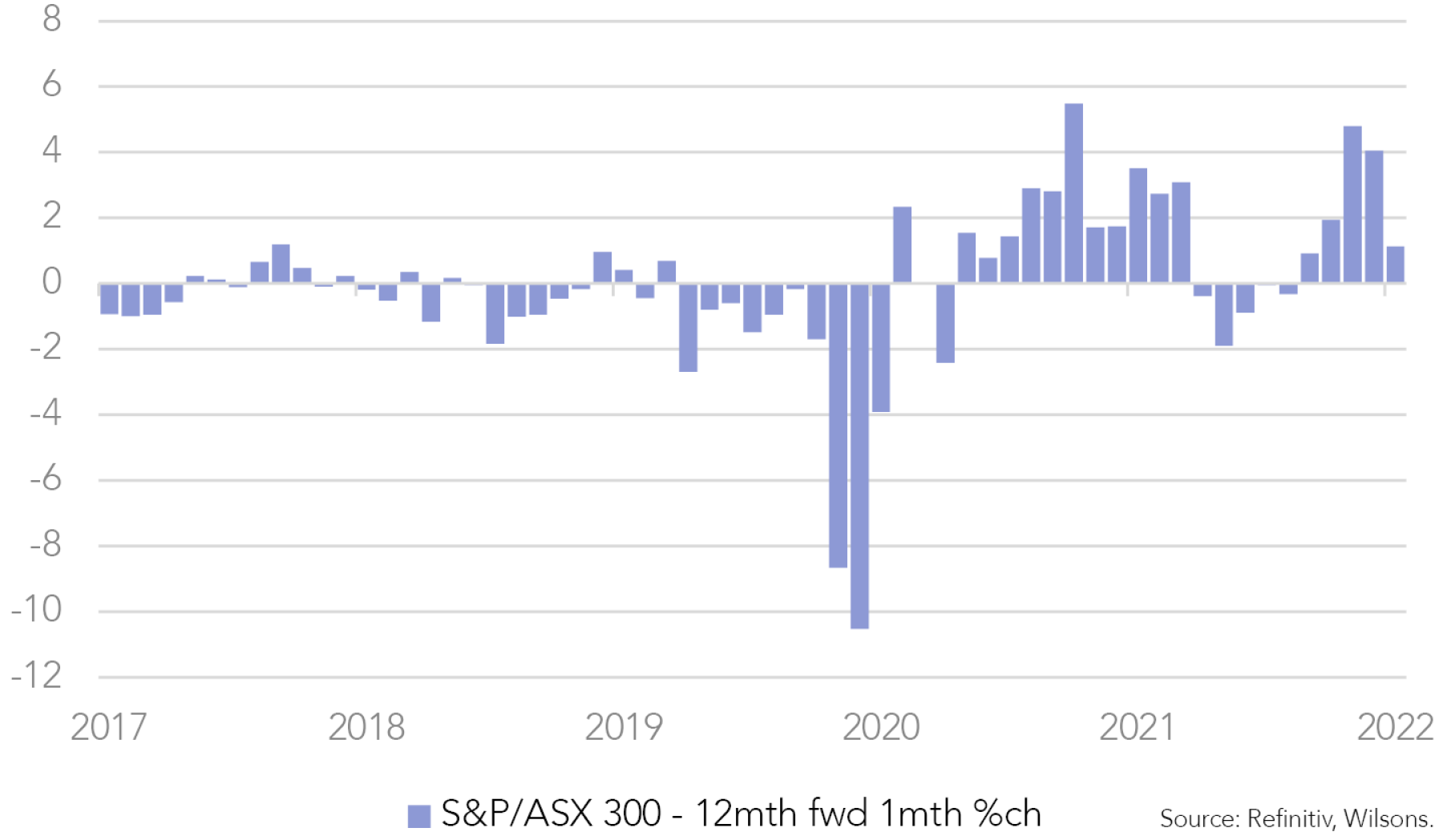

We have probably entered a more mature part of the cycle, with GDP likely continuing to slow from here. This is simply a slowdown from the higher growth phase of the cycle. It does not mean we are experiencing negative economic growth, it just means we are not growing at the same rate as previously. However, investors will have to navigate a period where economic and earnings growth could be vulnerable to downward revisions.

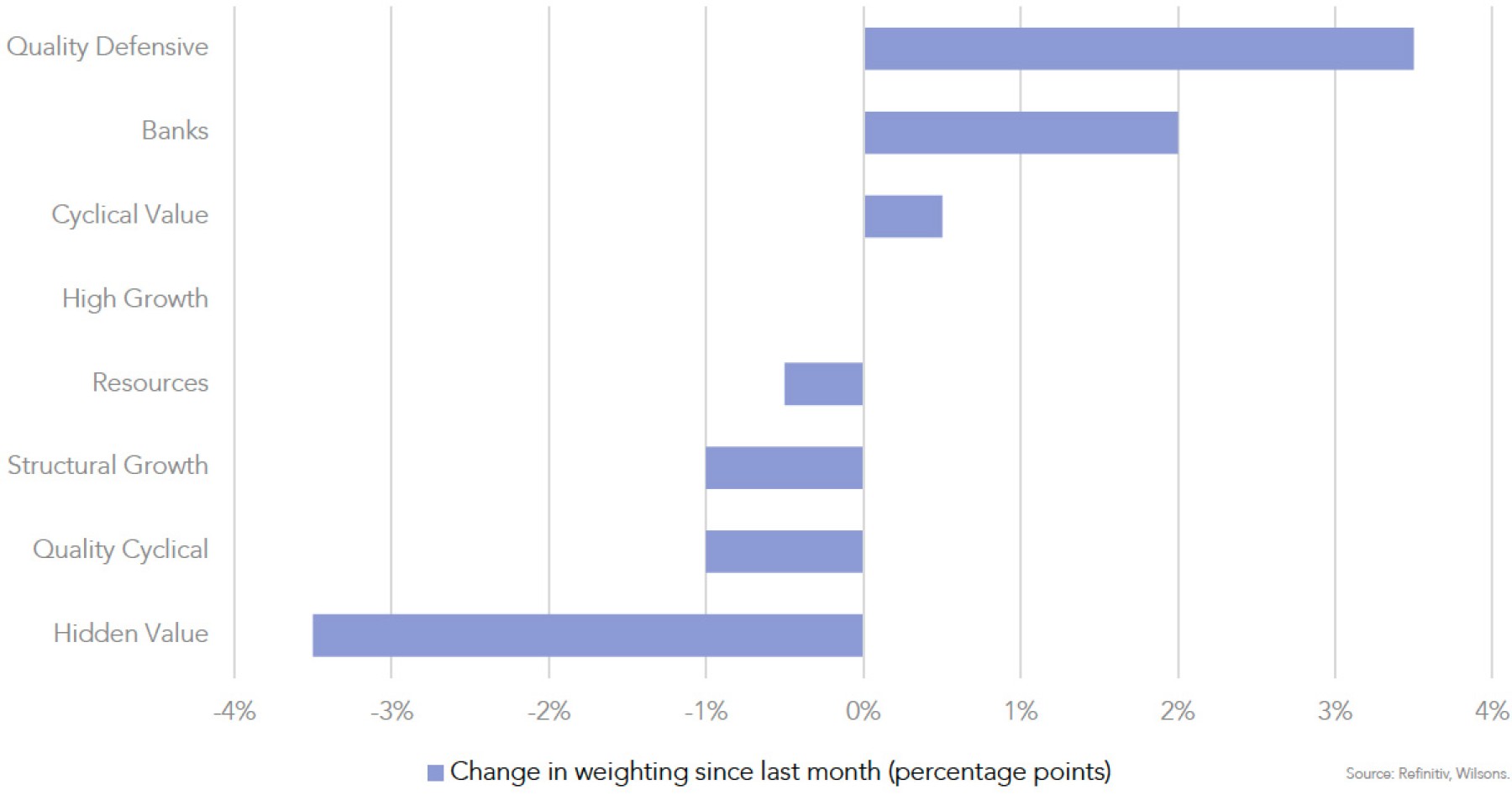

Looking ahead, we have increased our weighting to higher quality businesses we believe will be more resilient to the increasing downside risk. We have reduced our overall beta of the portfolio to reflect the lower returns and higher volatility we expect to see. We have also increased our weighting to companies we feel are less likely to disappoint as economic growth and earnings growth slow. Companies with stable earnings growth and margins should be looked at favourably in this stage of the cycle.

Inflation hedging is important as the globe experiences the current price pressures, especially while in the midst of the Ukraine/Russia conflict (and we think this conflict could go on for a bit longer). Energy and materials are a good source for inflation hedging, and we continue to like energy as a source of inflation protection over the next 6-12 months.

Despite slowing economic growth, we still believe banks can outperform as Net Interest Margins (NIM) expand over the next year in tandem with rate rises from the RBA, leading to earnings growth. In our view, the rate hike cycle and corresponding higher NIMs should offset the slowdown in credit growth as rates rise. Asset quality should remain robust as household and corporate balance sheets are generally healthy.

We maintain a substantial underweight to goods retailers, especially those that have benefitted from the pandemic environment, such as electronics and household goods. Stocks like JB Hi-Fi (JBH), Harvey Norman (HVN) and Wesfarmers (WES) have been sold off over the last 6 months. Even so, we still believe that these stocks could face further earnings downgrades as margins are further squeezed by inflationary pressures.

We remain underweight the consumer staples sector, with the pandemic and food inflation leading to earnings volatility that keeps us cautious on this sector. However, we believe this sector should outperform in the latter part of the cycle. We still do not see valuations as compelling, but if more indicators start flashing red on the state of the economy this will likely be a catalyst for adding this sector to the Focus List.

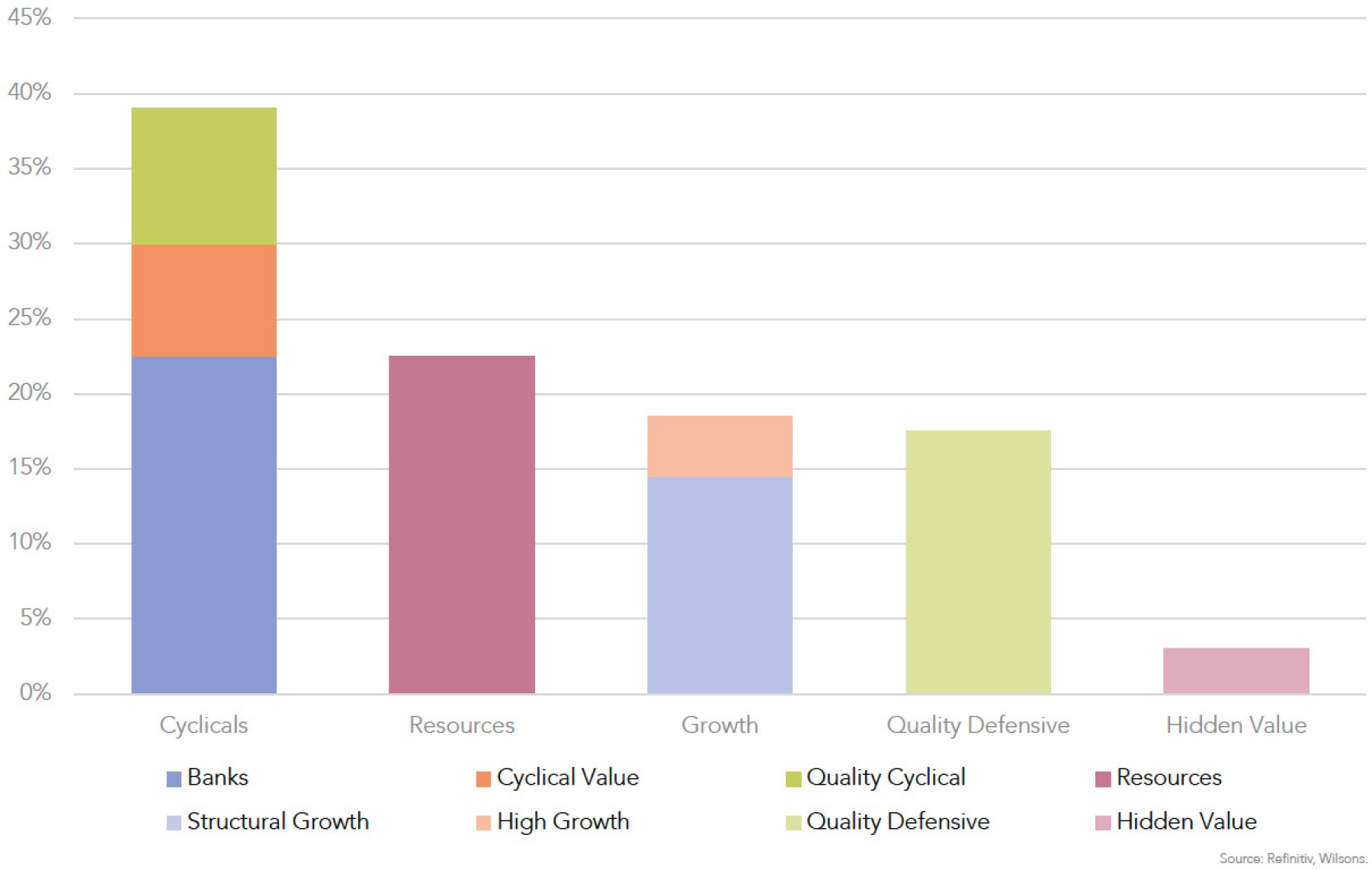

| Factor | Sectors | May Weighting | June Weighting | Focus List Stocks | ISG View |

| Cyclical | Resources | 23.0% | 22.5% | BHP, STO, WDS, OZL, NST, AKE | The Focus List is underweight resources at a headline level, but this is predominately due to our weighting in iron ore focused miners rather than our weighting to other sub sectors. We like resoruces as an inflation hedge and protection against a longer than expected Russia/Ukraine conflict. China's COVID lockdowns have added some risk to iron ore demand in the short-term, but could lead to more Chinese stimulus in the next 12 months. Energy remains our biggest overweight and we have added Woodside (WDS) to provide the Focus List with a higher weighting to the energy sector while adding some diversifcation in our exposure to the sector. Focus List is Overweight: Energy, Copper, EV minerals. Underweight: Iron Ore. |

| Banks | 20.5% | 22.5% | NAB, WBC, ANZ, JDO | The Focus List moved to overweight the banks in May. After the HY results we have remained positive on the banks. As we enter a period of rate hikes from the RBA, banks' margin pressure will likely ease, and ultimately this will be the key driver of earnings growth over the medium-term. We believe the net interest margins (NIM) of the majors will grow faster than consensus forecasts, leading to earnings upgrades over the next 2 financial years. Additionally, we believe bank valuations are still on the cheaper side, which could provide an opportunity for a rerate in the short-term. We believe business lending bank NAB is better positioned to grow loans in the next phase of the cycle than home loans since there has been such intense competition in mortgages. We therefore have a higher weighting in banks like NAB over the home lenders. However, we believe valuations for Westpac and ANZ will start to rerate as we see margin improvement. |

|

| Cyclical Value | 7% | 7.5% | QAN, SVW, TAH | We have a preference for cyclical stocks with low PE multiples in a rising rates environment. Resources and banks provide us a large allocation to these sectors but we also hold QAN (as a recovery play) and SVW . We still believe SVW is a misunderstood stock. Boral, Coates, and Westrac have become more defensive over the past decade, more reliant on government infrastructure and mining opex than on the domestic economy. We consider this stock to be good value with a PE ratio of 10x and earnings growth of 16%. Once the market realises that SVW has less volatile earnings than expected, it may rerate the stock. |

|

| Quality Cyclical | 10% | 9% | MQG, JHX | We believe that these quality cyclicals will continue to generate high returns on capital at this point in the cycle, even though higher bond yields are putting pressure on valuations. MQG and JHX remain core holdings of the Focus List. JHX has underperformed YTD as the market seems concerned on the US housing market. We have trimmed our weighting as we get slightly more concerned on the cycle. We still think JHX can increase margins and continue to generate earnings growth over the next few years. At a 12mth fwd PE of 14x, this stocks looks cheap with the risk to the upside in our view. |

|

| Growth | Structural Growth | 15.5% | 14.5% | ALL, GMG, SEK, SLA, PNI | The Focus List has a structurtal bias towards quality growth. We still hold these stocks as we believe they have a strong growth trajectory over the medium-term, but higher bond yields have heightened valuation pressure over the past 3-6 months. In our opinion, the growth stocks in the Focus List have been oversold over the past few months. The average 12mth fwd PE of these stocks is 20x, below the ASX industrials PE and therefore look reasonable value. If we get to a point where we believe US bond yields are starting to peak, we would get more constructive on growth names. |

| High Growth | 4% | 4% | XRO, TLX | We remain cautious on high-growth stocks that are likely to be highly volatile as the market adjusts to the current risks. Even though we believe some of these high-growth companies are excellent companies, we remain underweight from a valuation perspective until we have greater clarity on inflation and interest rates. | |

| Defensives | Quality Defensive | 14% | 17.5% | CSL, IAG, TLS, HCW, TLC | We currently have a preference for quality defensives. In a late-cycle environment, we prefer companies we believe will be resilient to the downside risks that are more prevalent in this part of the cycle. Additionally, given the level of uncertainty and volatility that is persistent in markets at the moment, we believe holding names that are less sensitive to the economy and rising rates to be a prudent decision. Our picks are healthcare, lotteries, insurance and telco. |

| Hidden Value | Hidden Value | 6% | 2.5% | NWS | We are always on the lookout for stocks with hidden value. We find this subset of the portfolio can provide above-market returns that are less correlated to the rest of the market. NWS should have catalysts to highlight value to the market over the next 12 months. |

Focus on the Tabcorp Demerger

In May, the Tabcorp (TAH) demerger created two new companies, The Lottery Corporation (TLC) and New Tabcorp (TAH). TLC comprises the lottery business while TAH keeps the wagering and media business.

We continue to like and hold both stocks but have a slight preference to TLC over the medium-term.

Why we like both TLC and TAH?

The Lotteries Corporation (TLC) – 3% weighting in the Focus List

We believe that the lotteries can rerate, providing upside to today’s share price. This is predicated on 3 factors:

- Lotteries is a defensive, infrastructure-like business with long-dated licences.

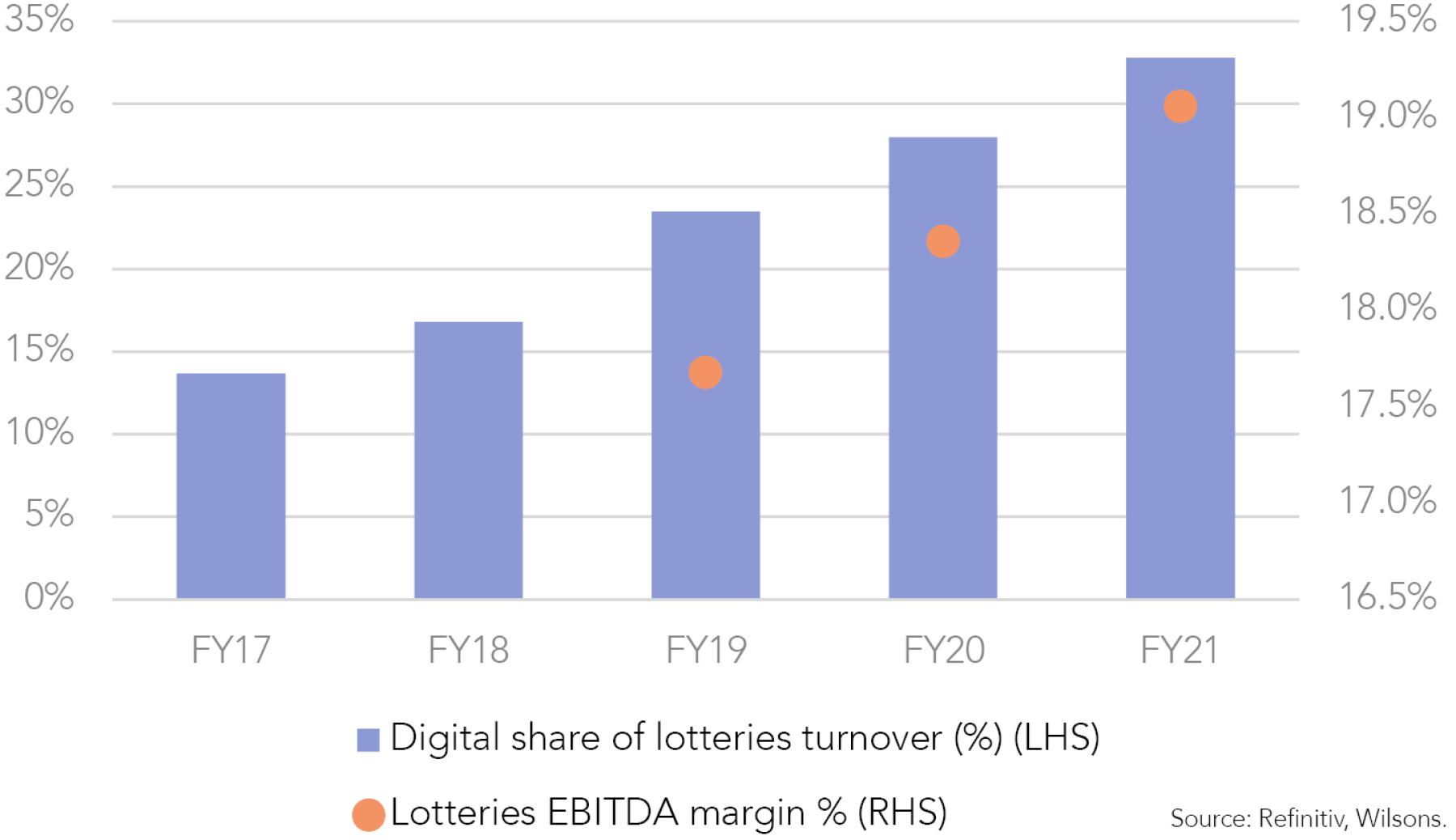

- Lotteries is growing its online presence which could lead to margin expansion.

- Lotteries is highly cash generative and capital light.

We believe holding an infrastructure-like business in the portfolio adds to our quality defensive factor, which is important as we shift from mid-cycle to late-cycle over the next 12 months.

We believe investors attribute a higher value to defensive companies than those at the mercy of the cycle. Therefore, as a standalone entity, we think the lotteries listed entity can rerate from its value today.

A bid could also be made for the lotteries business after the demerger. Private equity firms typically like annuity-like, defensive companies, just like the lotteries business.

Tabcorp (TAH) – 1% weighting in the Focus List

The wagering and media business should still have upside due to the continued economic reopening. While negatively impacted by COVID-19 these earnings should recover in the next 1-2 years, and we think this could lead to earnings upgrades.

Now that the business is demerged, further bids may be made for the New Tabcorp (Wagering, Media and Gaming Services). Global betting company Entain (ENT.L) and private equity giant Apollo have both bid for TAH’s wagering business in 2021. Apollo offered $4bn for the wagering, media and gaming services businesses combined.

The current market cap of TAH is ~$2bn and there seems a valuation gap to the bid’s pre-demerger.

Energy Sector Composition Change

Woodside (WDS) - 3% weighting in the Focus List

The energy index has changed since last month after the merger of Woodside (WDS) and BHP's petroleum (BHP-P) assets.

The Focus List received around ~1% in WDS from the in specie dividend from BHP after the merger.

The energy sector is now 5.5% compared to 4.1% at the end of May as WDS's market weight increased substantially after the merger of BHP-P’s assets.

We have increased our energy weighting from 5-7% to maintain an overweight position as we still have a positive view on the oil and gas market.

We still have a preference to Santos (STO) but like WDS after the merger of the BHP-P assets. WDS is well positioned to benefit from the continuing oil and gas upcycle, due to:

- WDS has one of the highest exposures to oil and gas prices in the Australian energy sector.

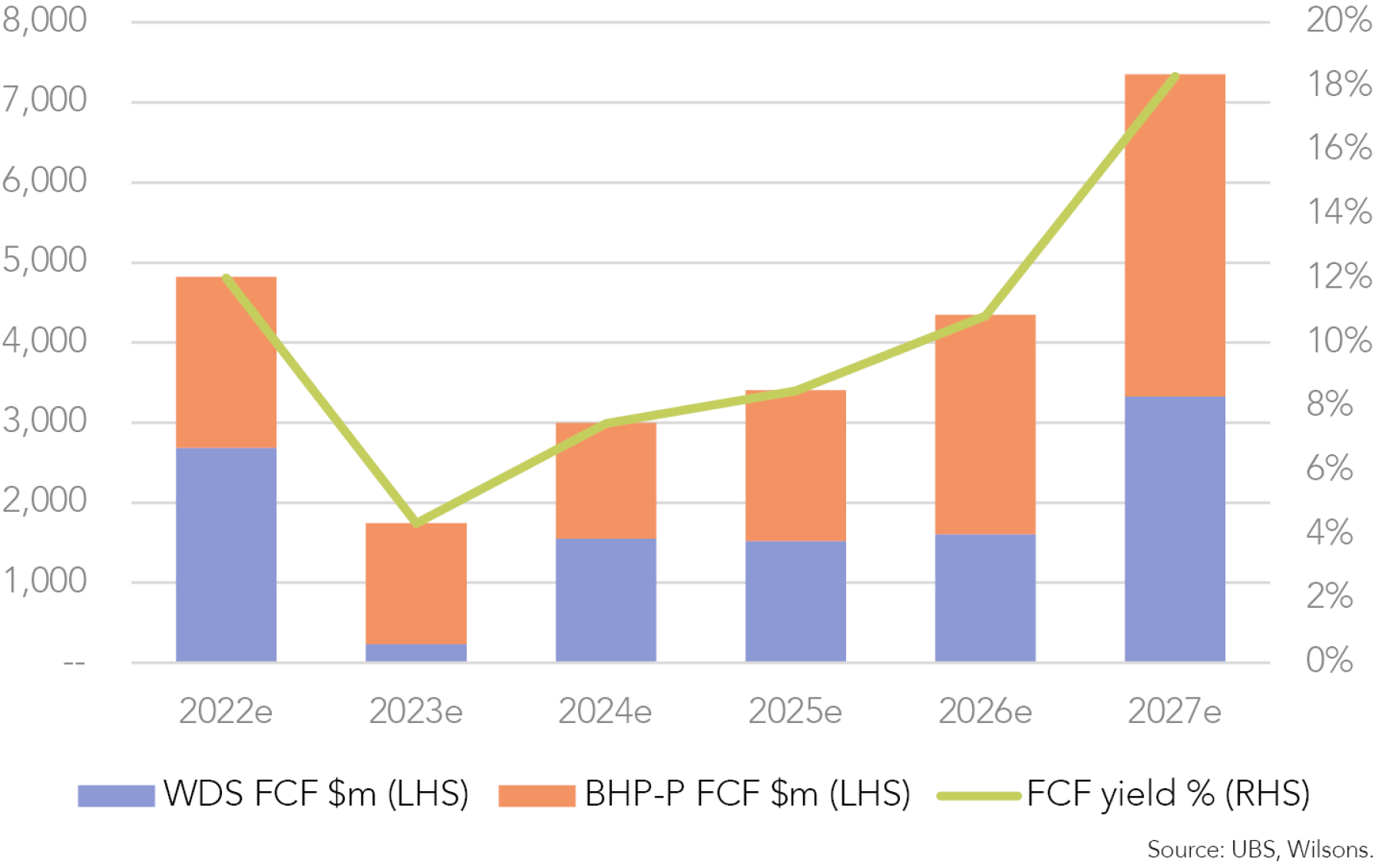

- We believe the merger between BHP-P and WDS provides substantial benefits to Woodside shareholders, mainly the significant step-up in free cash flow (FCF) that gives WDS the ability to self-fund expansion without coming to the market (a concern for us previously).

- The merger diversifies by product, project and geography.

Santos (STO) – 4% weighting in the Focus List

We have trimmed our exposure to STO by 1% as we diversify our holdings in energy and increase our weighting in Woodside (WDS). We still remain overweight.

BHP (BHP) – 8% weighting in the Focus List

We have trimmed our exposure to BHP by 1% to reflect the change in market weight after the sale of the BHP-P assets in May to Woodside (WDS). We remain underweight.

Other Changes to the Focus List

Increases

CSL Limited (CSL) +0.5%

Increasing our weighting to CSL to add more exposure to quality defensives in a stock we believe still has earnings recovery as the world reopens and plasma collection normalises. We remain overweight.

Trimming

James Hardie (JHX) -1%

JHX has underperformed YTD as the market seems concerned on the US housing market. We have trimmed our weighting as we get slightly more concerned on the stage of this cycle and the impact on JHX’s earnings. However, we are still positive on the stock.

We think JHX can still increase margins and continue to generate earnings growth over the next few years, even as the business cycle matures. At a 12mth fwd PE of 14x this stock looks cheap with the risk to the upside in our view.

Seven Group Holdings (SVW) -0.5%

We have trimmed SVW to be less overweight as we enter a slower part of the cycle.

We still believe SVW is a misunderstood stock. Boral (BLD), Coates, and Westrac have become more defensive over the past decade and more reliant on government infrastructure and mining opex than on the domestic economy. We consider this stock to be good value with a PE ratio of 10x and earnings growth of 16%. Once the market realises SVW has less volatile earnings than expected, it may re-rate the stock.

Northern Star Resources (NST) -0.5% and SEEK (SEK) -0.5%

In response to the market moves in these stocks we have trimmed our overweight in NST and SEK.

| Ticker | Company Name | Old Weighting | New Weighting | Change | Wilsons Factor | Share Price | Market Cap (A$b) |

Forecast Multiples | EPS | EPS | EPS | EPS CAGR % | Dividend Yield % | ROE | Net Debt/EBITDA |

Consensus Recommendation Mean (5 = Strong Sell, 1 = Strong Buy) | |

| 12mth fwd PE | 12mth fwd EV/EBITDA | FY1 | FY2 | FY3 | (FY1-FY3) | 12mth fwd | (FY1) | (FY1) | |||||||||

| WBC | Westpac Banking Corp | 6.0% | 6.0% | 0.0% | Banks | 23.92 | 83.9 | 13.2 | NULL | 1.53 | 1.90 | 2.13 | 18% | 5% | 8% | NULL | 2.6 |

| BHP | BHP Group Ltd | 9.0% | 8.0% | -1.0% | Resources | 46.34 | 235.1 | 8.8 | 4.7 | 4.36 | 3.79 | 2.73 | -21% | 8% | 43% | 0.1 | 2.4 |

| NAB | National Australia Bank Ltd | 8.5% | 8.5% | 0.0% | Banks | 31.11 | 100.1 | 13.9 | NULL | 2.10 | 2.28 | 2.41 | 7% | 5% | 11% | NULL | 2.4 |

| CSL | CSL Ltd | 7.0% | 7.5% | 0.5% | Quality Defensive | 270.86 | 130.7 | 33.3 | 20.8 | 4.93 | 5.85 | 6.84 | 18% | 1% | 19% | 2.3 | 1.8 |

| IAG | Insurance Australia Group Ltd | 3.0% | 3.0% | 0.0% | Quality Defensive | 4.21 | 10.4 | 13.7 | 9.7 | 0.19 | 0.31 | 0.33 | 30% | 6% | 8% | NULL | 2.4 |

| STO | Santos Ltd | 5.0% | 4.0% | -1.0% | Resources | 8.57 | 29.1 | 7.9 | 4.7 | 0.85 | 0.70 | 0.59 | -17% | 4% | 19% | 0.6 | 2.0 |

| TLS | Telstra Corporation Ltd | 2.0% | 2.0% | 0.0% | Quality Defensive | 3.89 | 45.0 | 23.3 | 7.8 | 0.14 | 0.17 | 0.18 | 14% | 4% | 11% | 1.6 | 2.2 |

| AKE | Allkem Ltd | 2.0% | 2.0% | 0.0% | Resources | 11.66 | 7.5 | 8.5 | 5.0 | 0.51 | 0.98 | 1.01 | 42% | 0% | 17% | -0.4 | 2.1 |

| JHX | James Hardie Industries PLC | 4.0% | 3.0% | -1.0% | Quality Cyclical | 33.86 | 15.1 | 13.8 | 9.3 | 1.73 | 1.86 | 1.96 | 7% | 4% | 46% | 0.5 | 1.9 |

| QAN | Qantas Airways Ltd | 4.0% | 4.0% | 0.0% | Cyclical Value | 5.32 | 10.1 | 13.9 | 5.0 | -0.67 | 0.38 | 0.70 | NULL | 2% | -138% | NULL | 2.2 |

| SVW | Seven Group Holdings Ltd | 3.0% | 2.5% | -0.5% | Cyclical Value | 18.90 | 6.9 | 10.1 | 8.0 | 1.57 | 1.87 | 2.10 | 16% | 3% | 16% | 2.7 | 2.0 |

| ALL | Aristocrat Leisure Ltd | 4.0% | 4.0% | 0.0% | Structural Growth | 33.91 | 22.8 | 18.6 | 11.3 | 1.68 | 1.86 | 2.04 | 10% | 2% | 23% | -0.1 | 2.1 |

| HCW | Healthco Healthcare and Wellness Reit | 2.0% | 2.0% | 0.0% | Quality Defensive | 1.73 | 0.6 | 18.8 | 13.8 | 0.06 | 0.09 | 0.11 | 32% | 5% | 4% | 7.9 | 2.0 |

| NWS | News Corp | 2.5% | 2.5% | 0.0% | Hidden Value | 24.42 | 14.2 | 18.1 | 6.8 | 0.88 | 0.97 | 1.13 | 13% | 1% | 6% | 0.5 | 2.0 |

| OZL | OZ Minerals Ltd | 3.0% | 3.0% | 0.0% | Resources | 24.15 | 8.1 | 14.7 | 7.3 | 1.66 | 1.63 | 1.42 | -8% | 1% | 14% | 0.5 | 2.5 |

| NST | Northern Star Resources Ltd | 3.0% | 2.5% | -0.5% | Resources | 8.58 | 10.0 | 16.9 | 5.0 | 0.29 | 0.51 | 0.62 | 45% | 3% | 4% | -0.1 | 1.7 |

| SEK | Seek Ltd | 3.0% | 2.5% | -0.5% | Structural Growth | 23.51 | 8.3 | 29.9 | 18.5 | 0.70 | 0.79 | 0.89 | 13% | 2% | 14% | 2.3 | 2.5 |

| GMG | Goodman Group | 4.0% | 4.0% | 0.0% | Structural Growth | 20.20 | 37.8 | 21.6 | 20.5 | 0.81 | 0.93 | 1.04 | 13% | 2% | 11% | 0.9 | 1.9 |

| MQG | Macquarie Group Ltd | 6.0% | 6.0% | 0.0% | Quality Cyclical | 182.90 | 70.3 | 16.9 | 28.9 | 10.71 | 11.26 | 11.69 | 4% | 4% | 14% | NULL | 2.3 |

| ANZ | Australia and New Zealand Banking Group Ltd | 5.0% | 5.0% | 0.0% | Banks | 24.82 | 69.5 | 11.3 | NULL | 2.09 | 2.22 | 2.40 | 7% | 6% | 10% | NULL | 2.5 |

| TLX | Telix Pharmaceuticals Ltd | 2.0% | 2.0% | 0.0% | High Growth | 4.15 | 1.3 | NULL | 974.4 | -0.17 | 0.07 | 0.28 | NULL | 0% | -89% | 2.9 | 1.5 |

| JDO | Judo Capital Holdings Ltd | 3.0% | 3.0% | 0.0% | Banks | 1.86 | 2.1 | 31.5 | NULL | 0.01 | 0.06 | 0.11 | 239% | 0% | 1% | NULL | 1.8 |

| XRO | Xero Ltd | 2.0% | 2.0% | 0.0% | High Growth | 84.38 | 12.6 | 206.6 | 43.1 | 0.37 | 0.70 | 1.33 | 89% | 0% | 5% | -0.5 | 2.2 |

| SLA | Silk Laser Australia Ltd | 2.0% | 2.0% | 0.0% | Structural Growth | 2.65 | 0.1 | 11.3 | 6.2 | 0.16 | 0.24 | 0.27 | 30% | 0% | 9% | 0.6 | 1.5 |

| PNI | Pinnacle Investment Management Group Ltd | 2.0% | 2.0% | 0.0% | Structural Growth | 7.98 | 1.6 | 17.6 | 16.0 | 0.41 | 0.45 | 0.52 | 13% | 5% | 23% | -0.4 | 2.0 |

| TAH | Tabcorp Holdings Ltd | 3.0% | 1.0% | -2.0% | Cyclical Value | 0.99 | 2.2 | 25.4 | 10.0 | 0.02 | 0.04 | 0.04 | 46% | 39% | 4% | 1.6 | 2.7 |

| WDS | Woodside Energy Group Ltd | 0.0% | 3.0% | 3.0% | Resources | 32.83 | 62.5 | 8.0 | 5.4 | 3.16 | 2.78 | 2.42 | -12% | 8% | 25% | 0.4 | 2.1 |

| TLC | Lottery Corporation Ltd | 0.0% | 3.0% | 3.0% | Quality Defensive | 4.42 | 9.9 | 25.2 | NULL | 0.16 | 0.18 | 0.19 | 7% | 4% | 193% | 3.1 | 2.3 |

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons: Wilsons is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons contains a financial product advice, it is general advice only and has been prepared by Wilsons without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons’ Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons’ disclosures at www.wilsonsadvisory.com.au/disclosures.