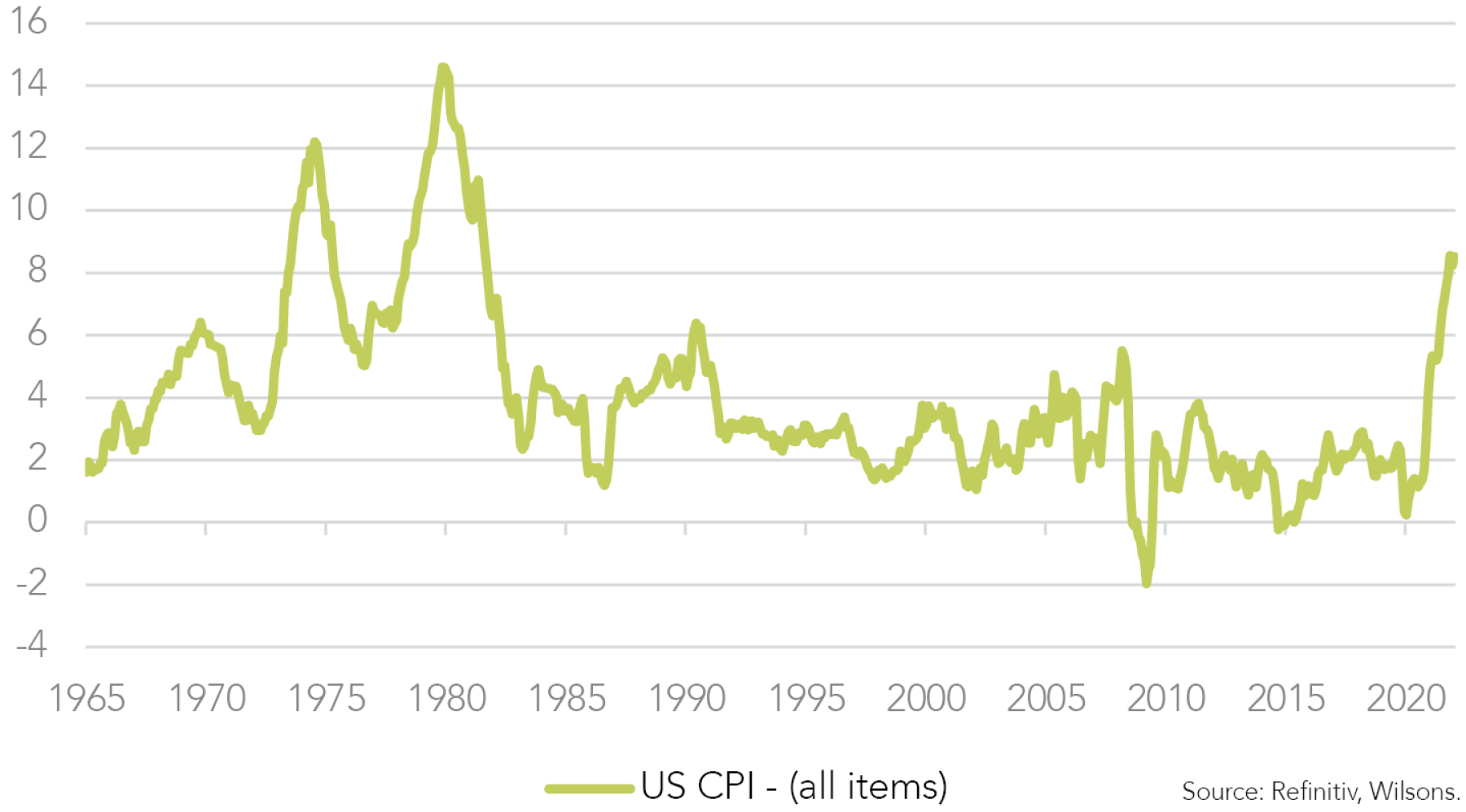

The market’s hopes for a peak in US inflation have been shaken over the past week by the release of a higher-than-expected May CPI print.

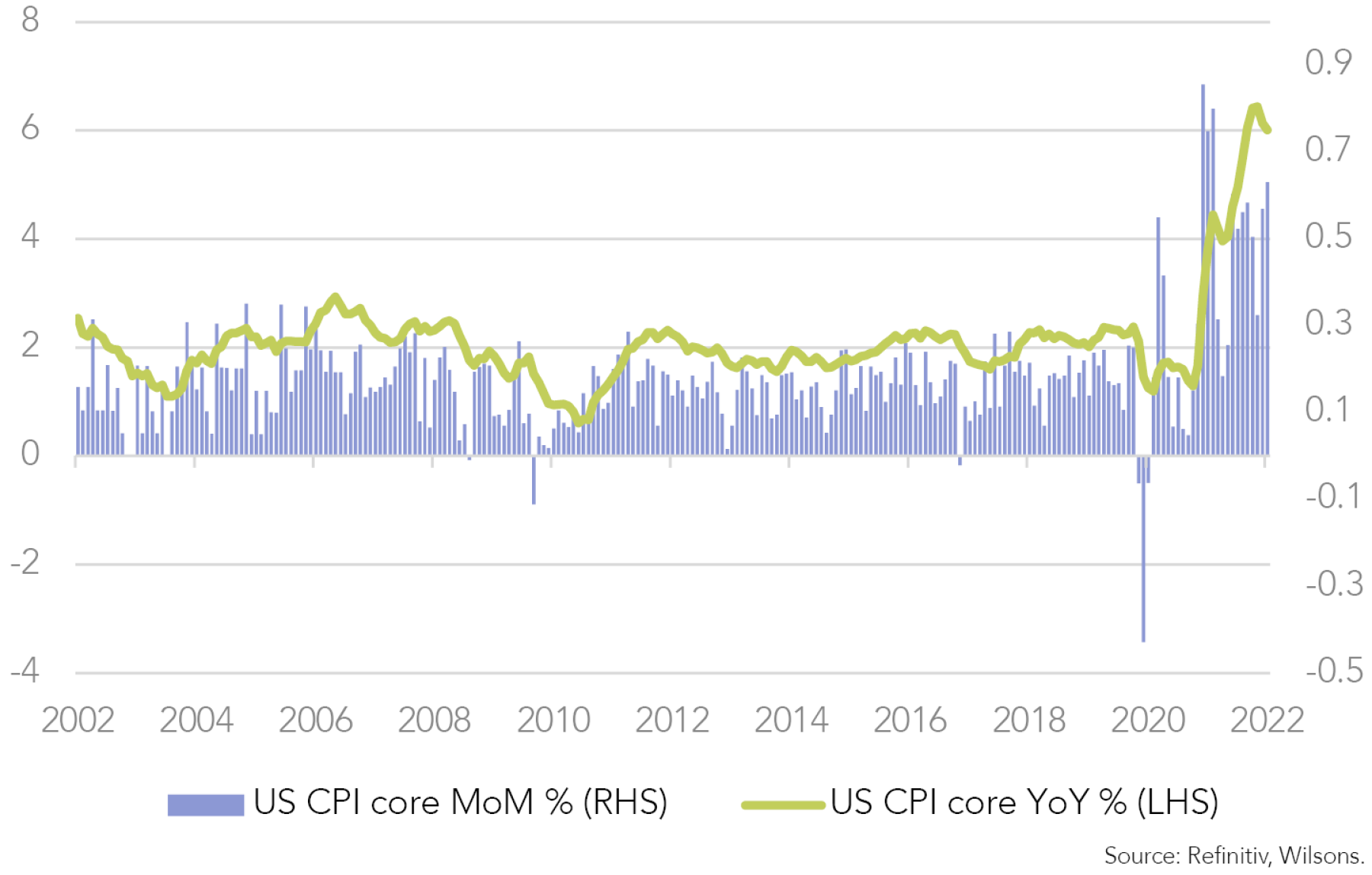

Headline inflation re-accelerated to 8.6%, eclipsing the recent 8.5% peak. Core inflation continued its easing trend falling back to 6%, although a sharp month-on-month (MoM) re-acceleration raised fears the year-on-year (YoY) peak in core inflation could also be temporary.

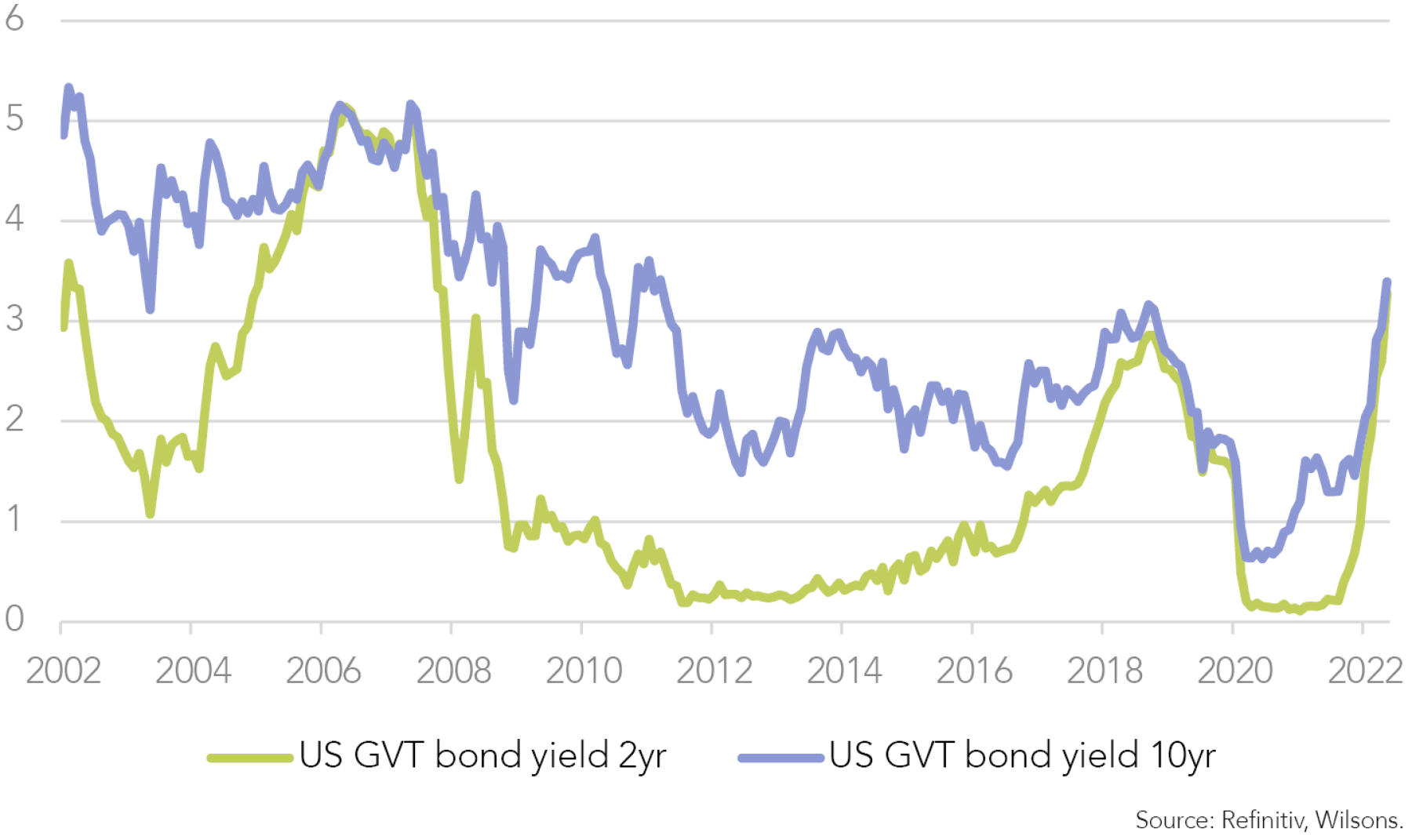

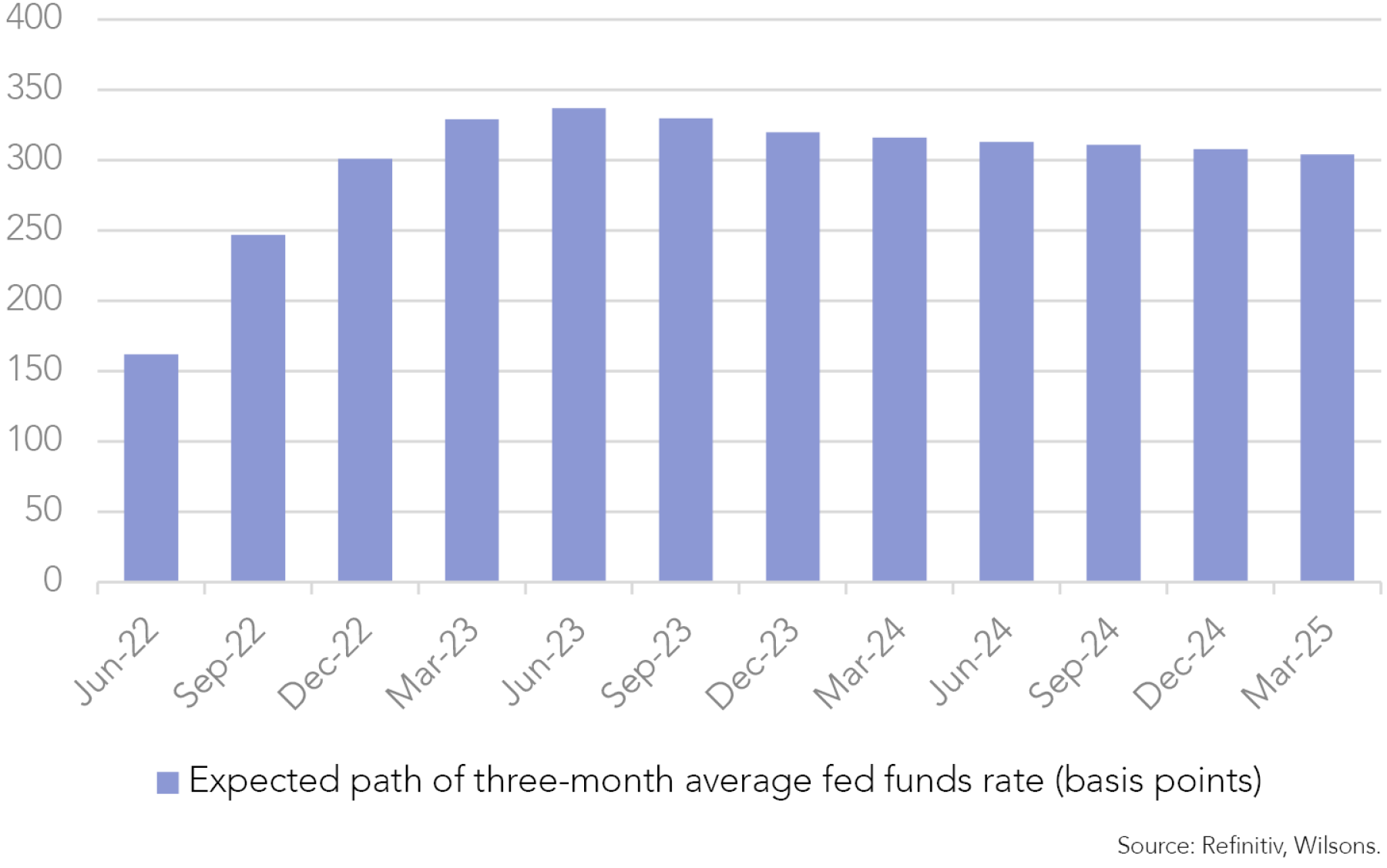

This hotter than feared inflation read caused the market to increase its expectations for US Fed policy tightening over the coming 12 months, with bond yields surging to fresh highs.

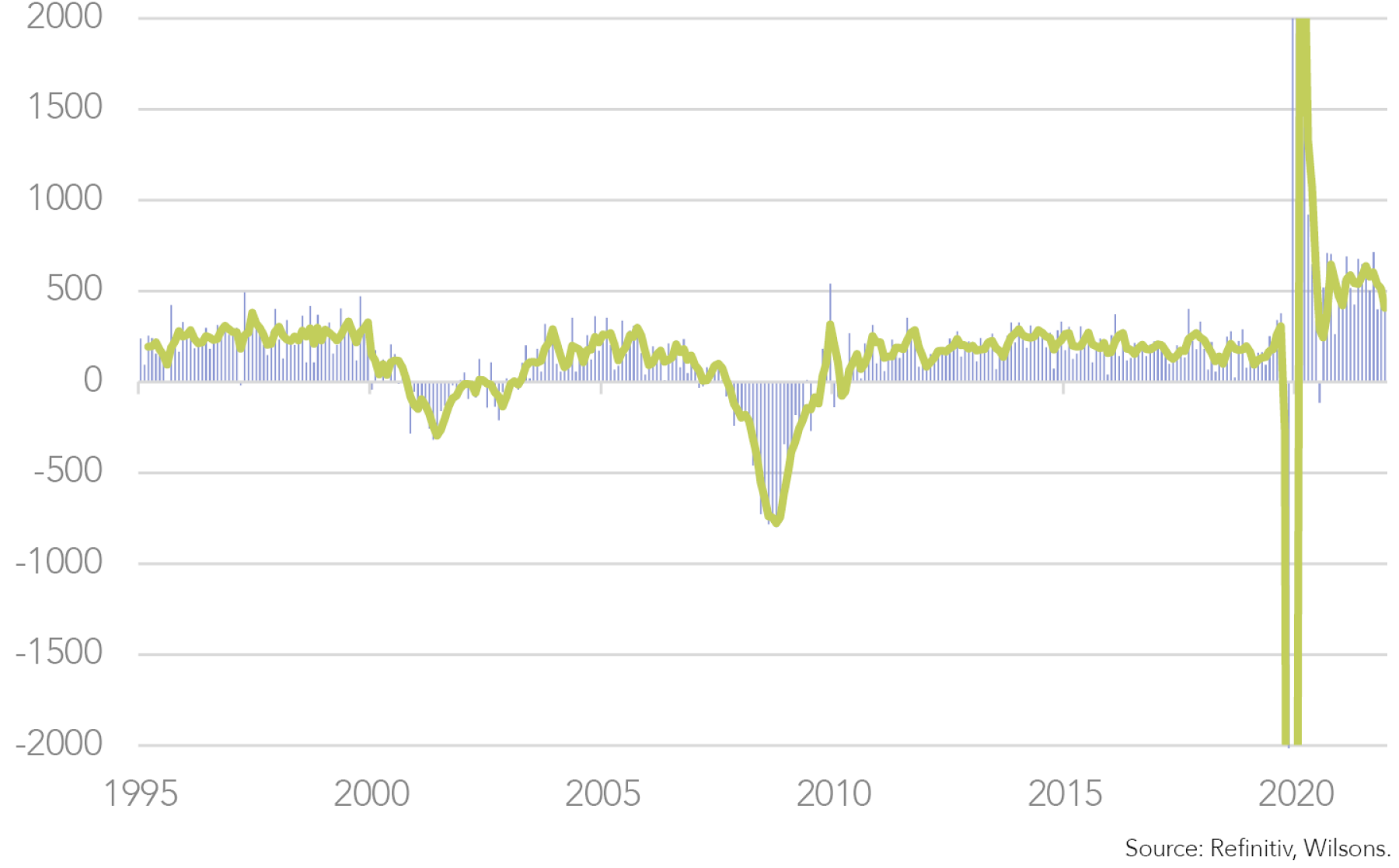

Equities have again sold off sharply as the market factors in higher discount rates and the rising risk of recession as the Fed attempts to contain inflation via higher policy rates.

In response to higher than expected inflation, the US Fed raised the funds rate +75bpt last week to ~1.6%. The Fed is now targeting a “restrictive” policy by the end of the year (i.e. above their estimated neutral rate estimate of 2.5%) to help restore price stability.

The July meeting could see another 50-75bp hike, according to Chair Jerome Powell. In his press conference, Powell noted there remained a (narrow) pathway for the Fed to achieve its goals of controlled inflation and ongoing economic expansion, but he did not want to induce a recession.

The US consumer was highlighted as resilient and the labour market strong. The US unemployment rate is expected to rise to 4% (current 3.6%) in the Fed’s 2023 projections. Powell also noted that factors beyond their control (e.g. geopolitics, supply-chain issues) will determine whether they can bring inflation down to 2%.

At the time of writing the market appears to have taken the Fed’s increased resolve to quell inflation well. The situation remains on a knife edge, with the market still very nervous around the prospect of stubbornly high inflation and the risk of the Fed missing its soft-landing target in its effort to tame inflation.

The Path to Lower Inflation

So, can inflation be tamed without inducing a recession? We think it can, though the risk of a period of stubbornly high inflation leading to a recession has clearly risen.

While the Fed has an important role to play in cooling a clearly overheated US economy, we continue to think a good deal of the current inflation pulse is supply-side driven and this is largely outside the Fed’s influence.

The supply-side inflation pulse largely emanates from the dislocation that began during the pandemic and was aggravated by the big bang of reopening.

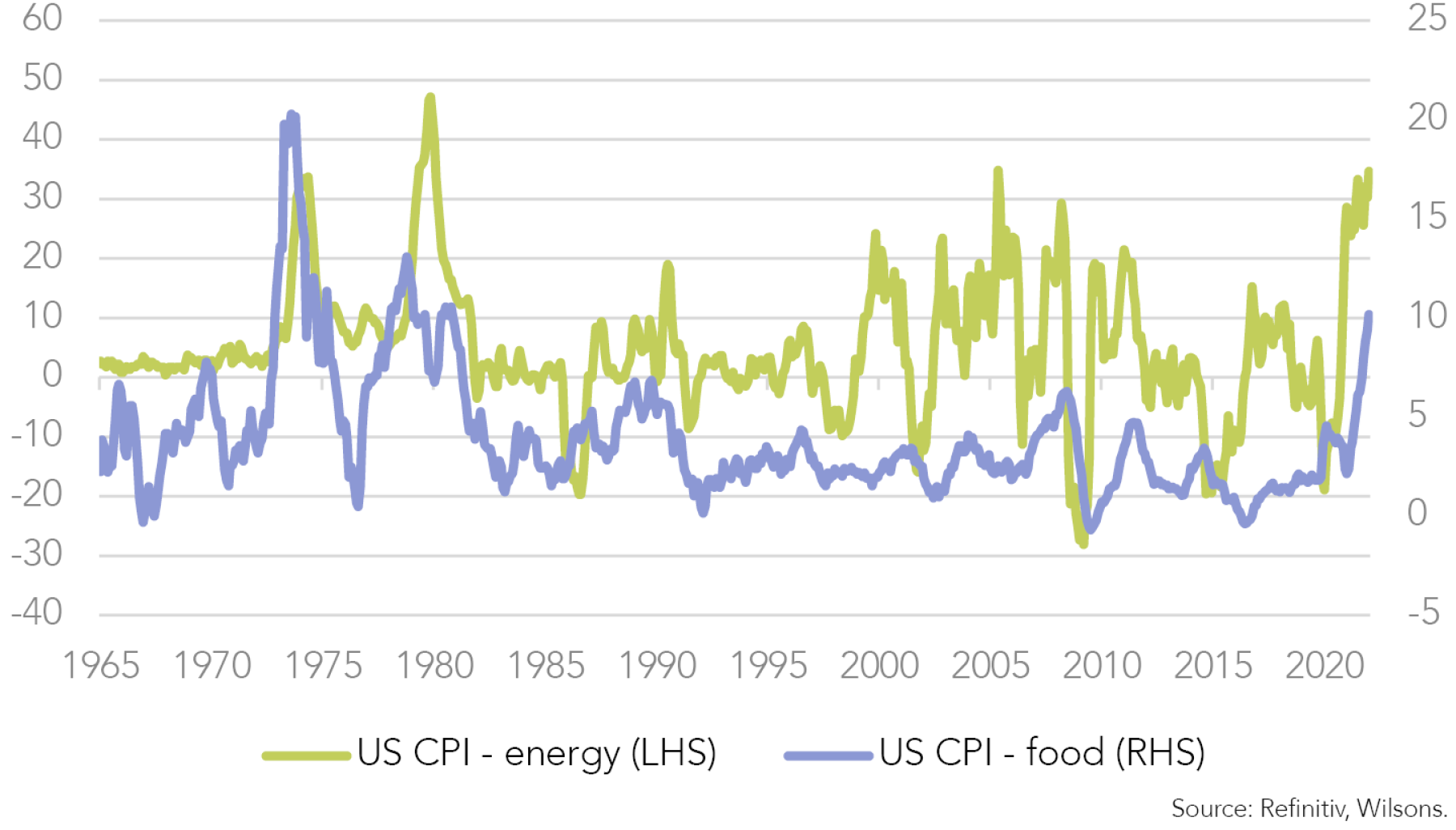

Russia’s invasion of Ukraine has clearly heightened supply chain problems and input cost pressures, most obviously through its impact on oil, gas and soft commodity prices. Recurring lockdowns in China over the past 3 months have also been a significant impediment to what was shaping as a steady improvement in the global supply chain.

Both Russia/Ukraine and China remain tail risks in respect to further supply-side disruption. However, we think China’s zero COVID resolve will ultimately subside, allowing significant improvement over the coming year. We are not counting on too much relief in respect of oil and food prices, though merely a flat profile for oil and soft commodities from here would see a dramatic reduction in the inflation contribution over the next 6-12 months.

Apart from tail risk in relation to another potential surge in food and energy prices, wage growth is a key risk to monitor. Greater participation, alongside slower overall economic growth, should take some edge off wage growth over the coming year and overt the risk of a wage-price spiral.

Preparing for a Slowdown

The combination of slower growth for both the global economy and the US, alongside supply-side improvements, have the ability to drive a significant decline in inflation from current elevated levels. Progress is likely to be moderate but visible on a 3-month view, but much more significant on a 6-12-month view.

This provides a pathway for the Fed to achieve a soft landing with the prospect that all the tightening is done by year-end. Lower inflation in 2023 opens the potential for at least modest cuts from the Fed later next year.

While the Fed’s record of achieving soft landings is not exactly stellar, we still attach a greater than 50% probability of the Fed achieving a soft landing given the lack of genuine financial market stress (unlike the GFC) and the relative health of the labour market and strong household balance sheets.

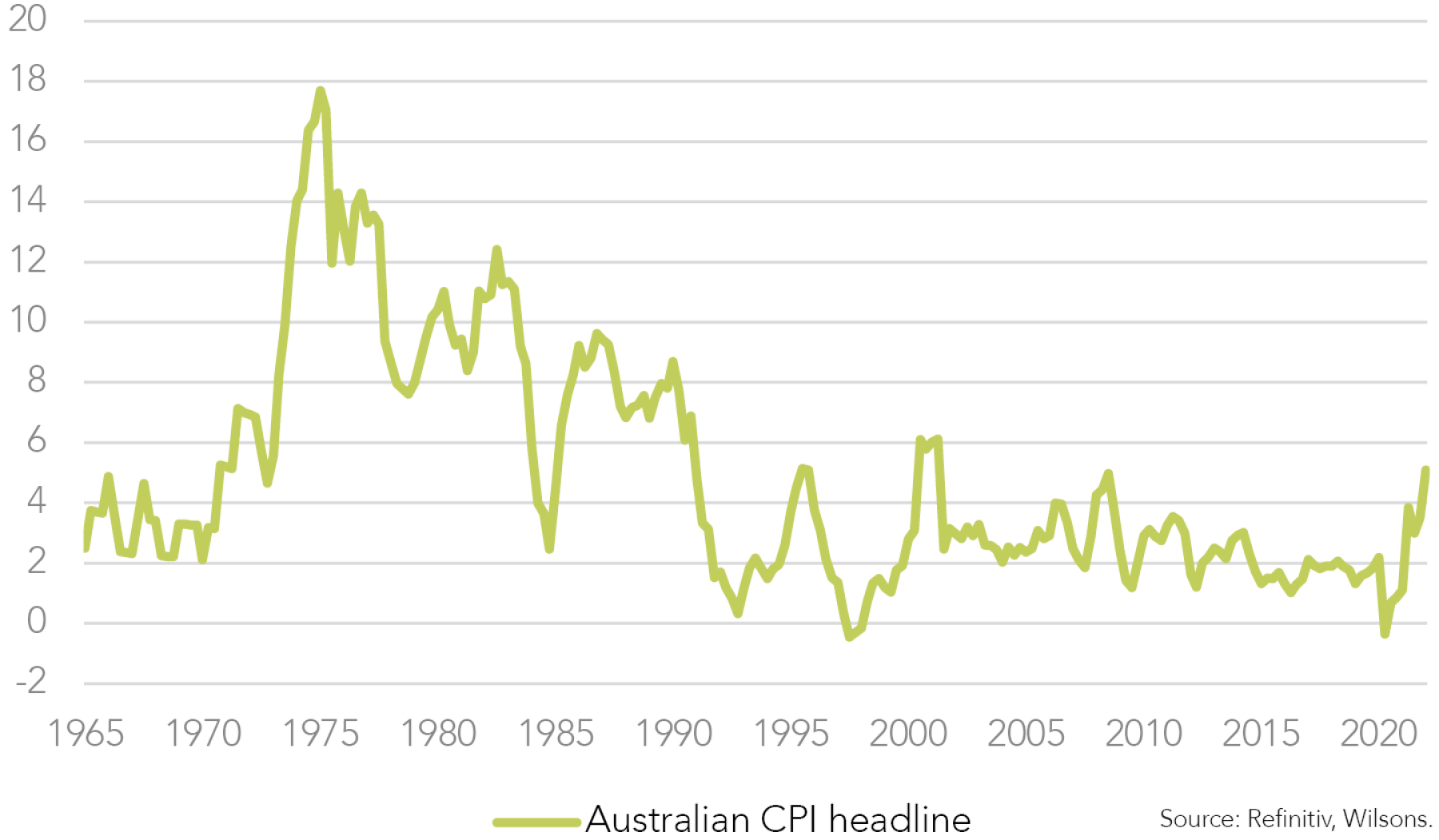

Investors need to be ready for a significant slowdown in the US and global growth pulse and probably an even bigger slowdown in the profit cycle, though we still think a significant drop in inflation over the next 6-12 months can ultimately allow lower interest rates and a relatively soft landing, thereby clearing a path for a recovery in bond and equity markets. Australian inflation will take longer to peak but market sentiment is likely to swing with the trend in US inflation.

Longer-term it is quite possible the trend rate of inflation (i.e. the 5-10 year outlook) is higher than the past 10-20 years. Influences such as deglobalisation and the energy transition look to be somewhat inflationary in our view. However, ongoing demographic ageing (sluggish trend growth) and ongoing technological innovation should continue to have a dampening influence on the long-term inflation backdrop. Our best guess is inflation averages on the high side of the Fed’s 2% target over the next 5-10 years as opposed to the experience of the past 10 years where it has typically settled on the low side of the Fed's target. We doubt if we are set for anything like the 70s or 80s period of structurally high inflation despite the elevated current readings.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons: Wilsons is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons contains a financial product advice, it is general advice only and has been prepared by Wilsons without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons’ Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons’ disclosures at www.wilsonsadvisory.com.au/disclosures.