Volatility in the markets often causes investors to seek ways to mitigate that risk.

Including quality or defensive stocks in a portfolio may be a good solution. With the return and volatility of quality defensives being historically superior to those of broader equities during choppy market conditions, investors may benefit from purchasing these stocks during turbulent times.

The year is off to a rocky start for many investors. Global equity markets dropped rapidly in January and have continued to experience volatility. Australia has fared better but has been hovering between -1 and -10% year to date.

While we do not think the global economy will go into recession or inflation will remain elevated, we believe having an above-average allocation to quality defensives during this period is sensible until we get more clarity on the global economy.

However, holding defensives in portfolios is not just about protection against the downside, quality defensives should also:

- Outperform in a slow growth environment, not just in recessions

- Have pricing power in inflationary environments

- Outperform over the long-term

We look for quality defensive stocks that possess the following characteristics:

- Ability to compound earnings over time

- Low beta to the market

- Monopolistic position in the market or a clear market leader

- High return on equity

In a sea of uncertainty, we hold a preference to stocks such as CSL (CSL), IAG (IAG), Telstra (TLS) and The Lottery Corp (TLC) - all of which are part of the Australian Equity Focus List.

In addition, we believe stocks like Orora (ORA), Woolworths (WOW) and Transurban (TCL) could be good additions for investors looking to increase portfolio quality.

Steady Growth Through the Cycle

The recurring revenues of defensive companies should be even more valuable as a source of earnings stability in an environment where recession risks are elevated.

Market participants are still concerned whether central banks, in particular the US Federal Reserve, can engineer a soft landing. Therefore, quality defensives should outperform as this risk persists.

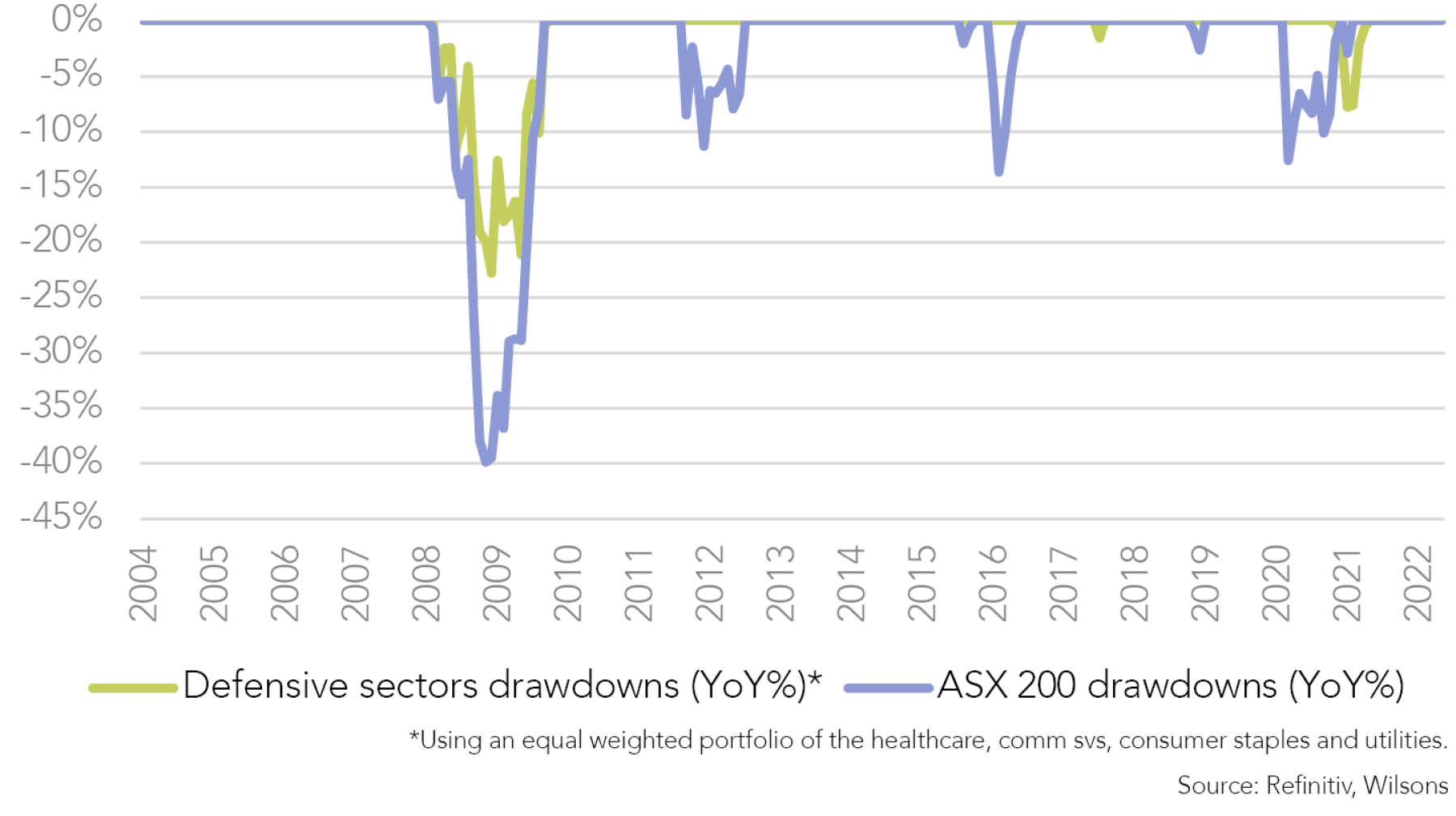

History has persistently shown that in times of volatility, defensive sectors have outperformed. Using a simple equal weighted portfolio of healthcare, communication services and consumer staples demonstrates that these sectors generally have smaller drawdowns than the market in periods of volatility.

While we do not think a recession is likely in the next 12 months, the uncertainty surrounding the economy should be a positive for defensive equities sentiment.

Quality defensives should be able to consistently provide stable earnings growth through a period of slower growth, while avoiding downgrades. This should drive investors to these stocks and generate above market returns for shareholders.

Quality Defensives Hold Pricing Power

A world of rising input costs and higher economic volatility makes pricing power and recurring revenue even more significant. Companies that can pass cost increases onto customers will likely be valued at a premium.

Quality defensive sectors usually have pricing power. No matter the level of inflation, households will have to buy food and pay their healthcare and utility bills. In some cases, quality defensive providers have such a strong market positioning, consumers have no choice but to use them.

For example, supermarkets like Woolworths and Coles should be able to pass increasing food prices onto consumers. Transurban’s monopolistic position means road users in Sydney, Melbourne or Brisbane are likely to use their toll roads on bridges and tunnels.

In a period of elevated inflation and with the risk of inflation persisting, pricing power could be a valuable attribute for quality defensives, leading to outperformance over the next 3-6 months (or possibly longer).

Outperformance in Different Economic Cycles, not just Downturns

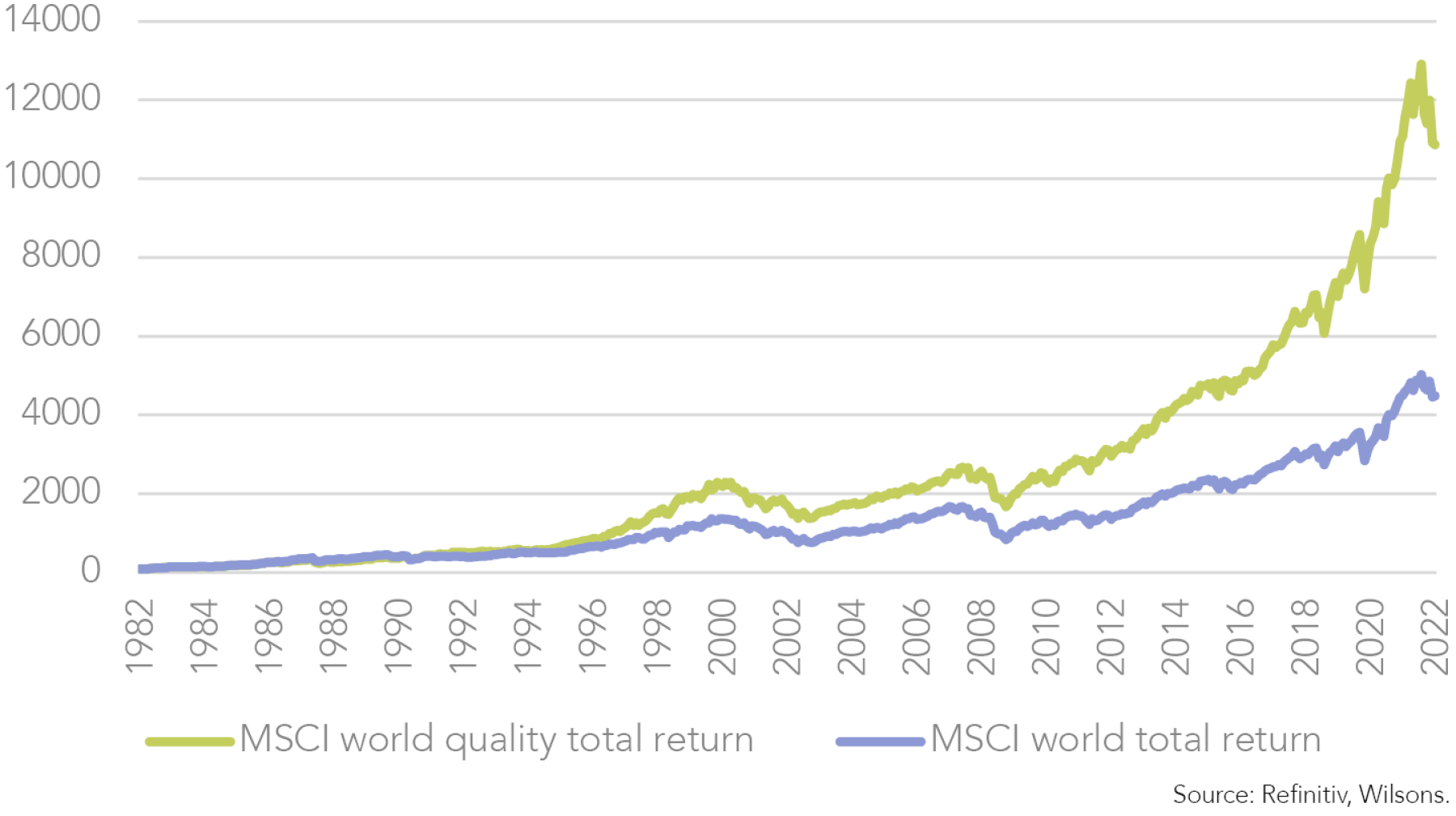

Quality defensive companies have demonstrated outperformance during periods of economic slowdown, but also over the long-term. Earnings growth for these companies may not shoot the lights out, but you do not have to sacrifice returns by owning defensive equities over the long-term.

Strong brands and competitive advantages are typical characteristics of quality companies. They tend to generate steady earnings growth regardless of economic conditions. The most important thing is that they operate at the highest levels of management efficiency, enabling them to generate sustainable earnings and free cash flow (FCF) that can be compounded into the future. We believe that is the key to generating high long-term returns.

Boring and Overlooked

Another reason why low-risk stocks outperform is that they are dull. The allure of headline stocks and the market's big daily gainers makes many investors overlook low-key stocks, which are then underrepresented in portfolios.

Even high-quality companies delivering consistent returns and growing shareholder value are subject to this problem. Those companies are too boring to own. The risk-return potential of high quality companies is not seen by investors because they ignore the potential risk profile. Therefore, investors will underpay for a quality company that will continue to increase in value over time.

Investing in a quality company that has low volatility might not get your heart racing like a high growth stock. However, in the long run, protecting your downside while compounding your returns is likely to pay off.

| Company Name | Ticker | Beta (5yr) | Price Change YTD | 12mth fwd PE | EPS CAGR (FY1-FY3) | 12mth fwd EPS Revision | Dividend Yield (FY1) | ROE FY23 |

| Healthcare | ||||||||

| CSL | CSL | 0.44 | -5.8 | 34 | 18% | 0.90% | 1.10% | 19% |

| Infrastructure | ||||||||

| APA* | APA | 0.42 | 13.8 | 20.3 | 5% | 0.80% | 4.60% | 15% |

| Transurban Group* | TCL | 0.77 | 5.1 | 24.5 | 28% | 10.80% | 2.70% | 8% |

| Insurance | ||||||||

| IAG | IAG | 0.33 | 5.9 | 15 | 31% | 3.60% | 3.60% | 12% |

| Medibank Private | MPL | 0.57 | -4.2 | 19.2 | 6.40% | 0.70% | 4.10% | 23% |

| Suncorp Group | SUN | 0.89 | 9.5 | 13.8 | 21% | 2.70% | 4.60% | 10% |

| Logisitics | ||||||||

| Brambles | BXB | 0.76 | 3.9 | 18.4 | 7% | -0.50% | 3.10% | 22% |

| Goodman Group | GMG | 0.93 | -23.1 | 22.1 | 13.20% | 2.20% | 1.50% | 12% |

| Packaging | ||||||||

| Amcor | AMC | 0.46 | 12.2 | 16 | 4% | 1.00% | 3.70% | 28% |

| Orora | ORA | 0.59 | 10.9 | 17.3 | 7.60% | 1.30% | 4.20% | 27% |

| Supermarkets | ||||||||

| Coles Group | COL | 0.29 | -1.8 | 21.5 | 8.50% | 0.90% | 3.50% | 34% |

| Metcash | MTS | -0.18 | -4.9 | 15.4 | 1.50% | 0.60% | 4.70% | 22% |

| Woolworths Group | WOW | 0.55 | -8.1 | 24.8 | 13% | 2.50% | 2.50% | 36% |

| Telecom | ||||||||

| Telstra | TLS | 0.68 | -5.5 | 23.7 | 14% | 1.30% | 4.10% | 13% |

Quality Defensive Stocks in the ASX 100

We have screened the S&P/ASX 100 for what we consider quality defensive names in 2022. These companies have:

- Equity market beta of less than 1

- Flat/positive consensus earnings revisions

- Positive 3-year forward EPS CAGR

- No significant short- to medium-term structural concerns

- Return on equity over 10% (ROE not screened for regulated assets)

Stocks that Screened Well

Consumer staples - Since people need to buy food and basic household items, stocks from these sectors can do well when volatility is high. Australia has a duopoly structure with Coles (COL) and Woolworths (WOW) the largest supermarket chains. The underperformance in WOW (-10% YTD) adds to the case for buying at current prices. WOW’s valuation premium to COL has also been eroded slightly over the past few months.

Healthcare - Considered a defensive sector since recessions rarely disrupt the need for medical care or medications. Many of these companies also have a competitive advantage through R&D capabilities or patents for their products/services. To us, CSL (CSL) is the definition of a quality defensive, with resilient earnings, high ROE and the ability to positively surprise the market, it is a core holding in the Focus List.

Insurance – Households and businesses need insurance, whatever the economic conditions. IAG (IAG) has traditionally been a high-quality insurer, although this has been tested over the past 2 years with COVID, bushfires and perils. We think IAG’s turnaround is on track, and this should lead to strong earnings growth over the next 12 months.

Telecommunications – Internet and mobile phone are deemed essential by most consumers. Providers like Telstra (TLS) operate within an oligopoly with solid pricing power. Earnings are unlikely to be volatile now competition in the market has subsided.

Toll roads – Toll roads are used every day to get from A to B and pre-COVID had steady, consistent earnings growth. Transurban (TCL) is our pick with its monopolistic power in NSW, VIC and QLD. TCL should be able to pass inflation costs onto the consumer as prices rise.

Industrial like names like Amcor (AMC), Orora (ORA) and Brambles (BXB) typically have little downside earnings risk, and are often seen as relative safe havens with annuity-style earnings from packaging and logistics revenues.

Striking a Balance When the Outlook is Cloudy

It is still unclear when growth stocks will outperform again and face potential headwinds, such as high interest rates. Betting everything on value stocks continuing to outperform, particularly when global economic growth is in question, is not without its own risks.

So, while the outlook is uncertain and as we go into a slower period for earnings, we believe that having a balance of quality defensives and quality value stocks in portfolios makes more sense than putting all our eggs in one basket.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons: Wilsons is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons contains a financial product advice, it is general advice only and has been prepared by Wilsons without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons’ Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons’ disclosures at www.wilsonsadvisory.com.au/disclosures.