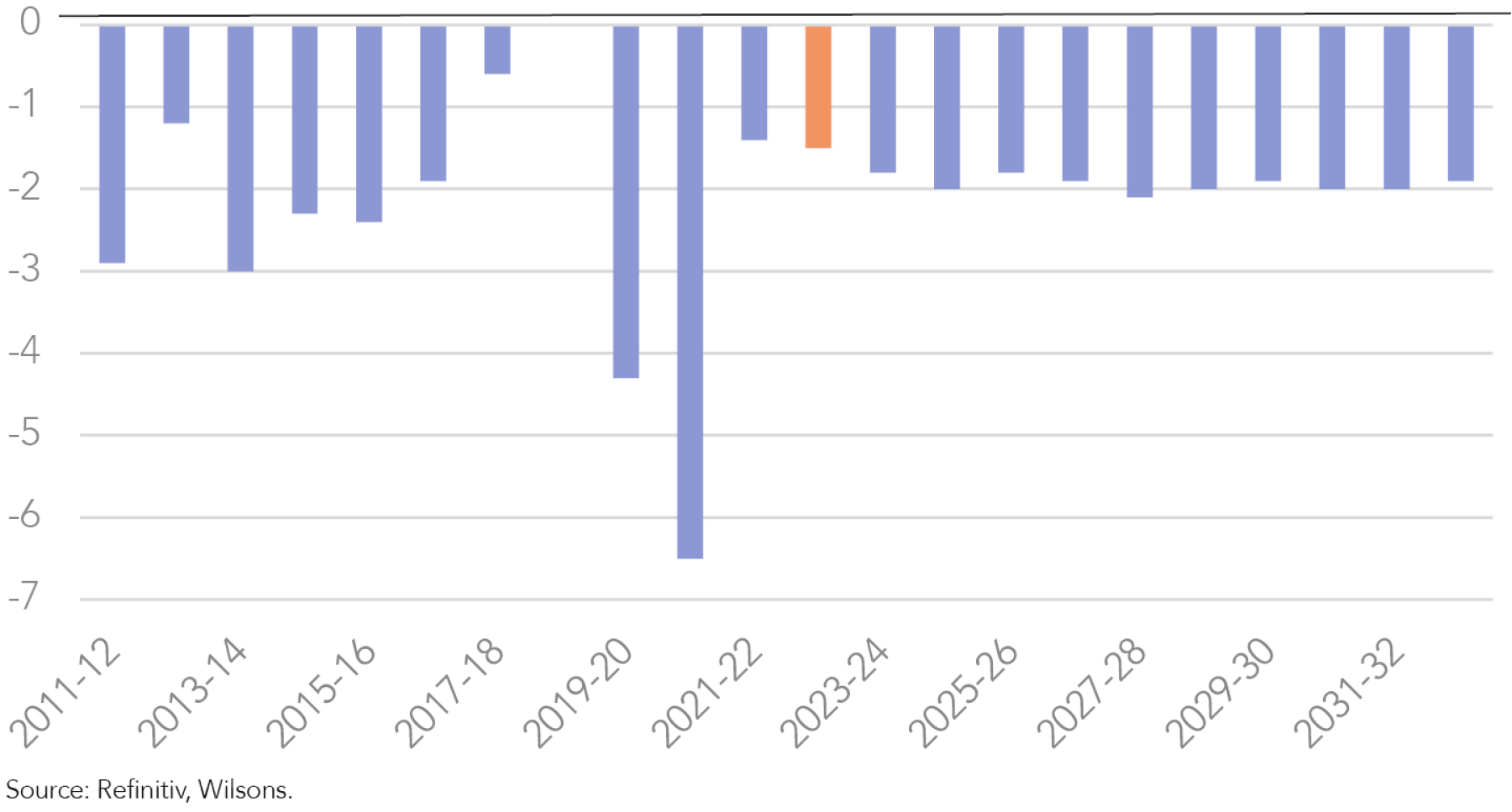

The FY23 budget deficit is now forecast to be a much smaller $37b (1.5% GDP) compared to the $78b predicted in the April pre-election fiscal update (PEFO).

This is due to an unexpected revenue boom driven by soaring commodity prices and low unemployment.

However, due to the inherent structural pressures on the budget, as well as treasury’s highly conservative commodity price forecasts beginning in FY23, the deficit begins to expand again in FY24 and stays stubbornly high.

| 2022-23 | 2023-24 | 2024-25 | 2025-26 | 4 year total | ||

| PEFO (April 2022) |

$bn % of GDP |

-77.9 -3.4 |

-56.5 -2.4 |

-47.1 -1.9 |

-42.9 -1.6 |

-224.5 |

| Revenue benefit economic & other changes | $bn | 42.2 | 11.7 | -2.2 | 0.8 | 52.5 |

| Deficit Pre new policy | $bn | -35.8 | -44.8 | -49.3 | -42.1 | -172 |

| New Policy changes • Receipts • Payments |

$bn $bn $bn |

-1.1 1.4 2.5 |

0.7 2.5 1.7 |

-2 4.0 6.0 |

-7.4 5.3 12.7 |

-9.8 |

| 2022-23 Budget (October 2022) |

$bn % of GDP |

-36.9 -1.5 |

-44 -1.8 |

-51.3 -2.0 |

-49.6 -1.8 |

-181.8 |

Source: Refinitiv, Wilsons.

Stubborn 2% Structural Deficit

By 2032-33, the deficit is estimated to still be 1.9% of GDP, a significant deterioration from the 0.7% of GDP forecast in the previous governments April update. This circa 2% “structural” budget deficit is the government’s key fiscal challenge and will likely result in tougher decisions needing to be made over the next couple of years.

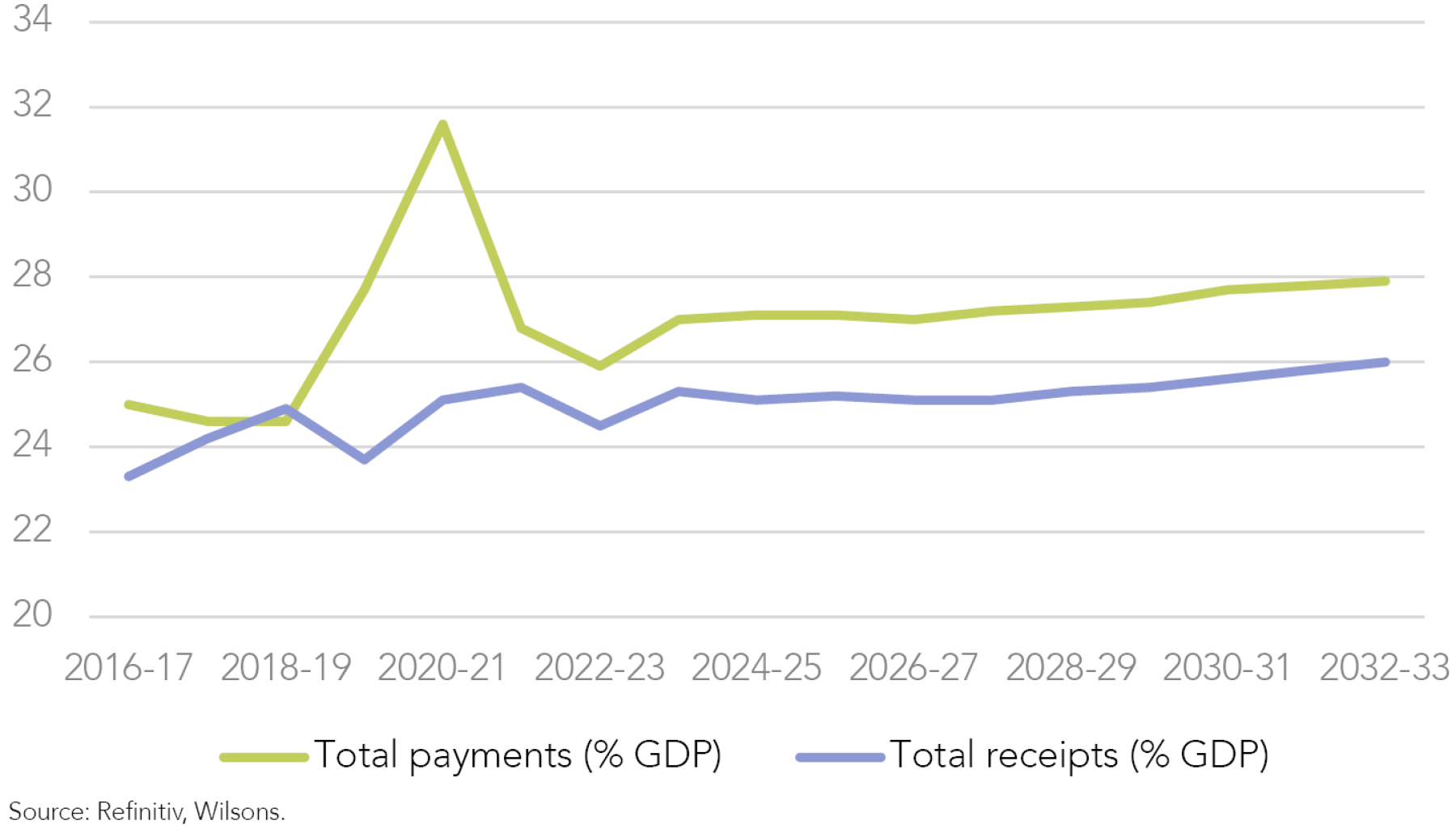

In essence spending is forecast to be “stuck” 2% above revenue permanently. The pre-COVID spending cap of 25% of GDP gave way in the COVID-induced spending surge. Government spending appears to have settled at a much higher 27% of GDP level. In contrast, revenues are forecast to track at around 25% of GDP.

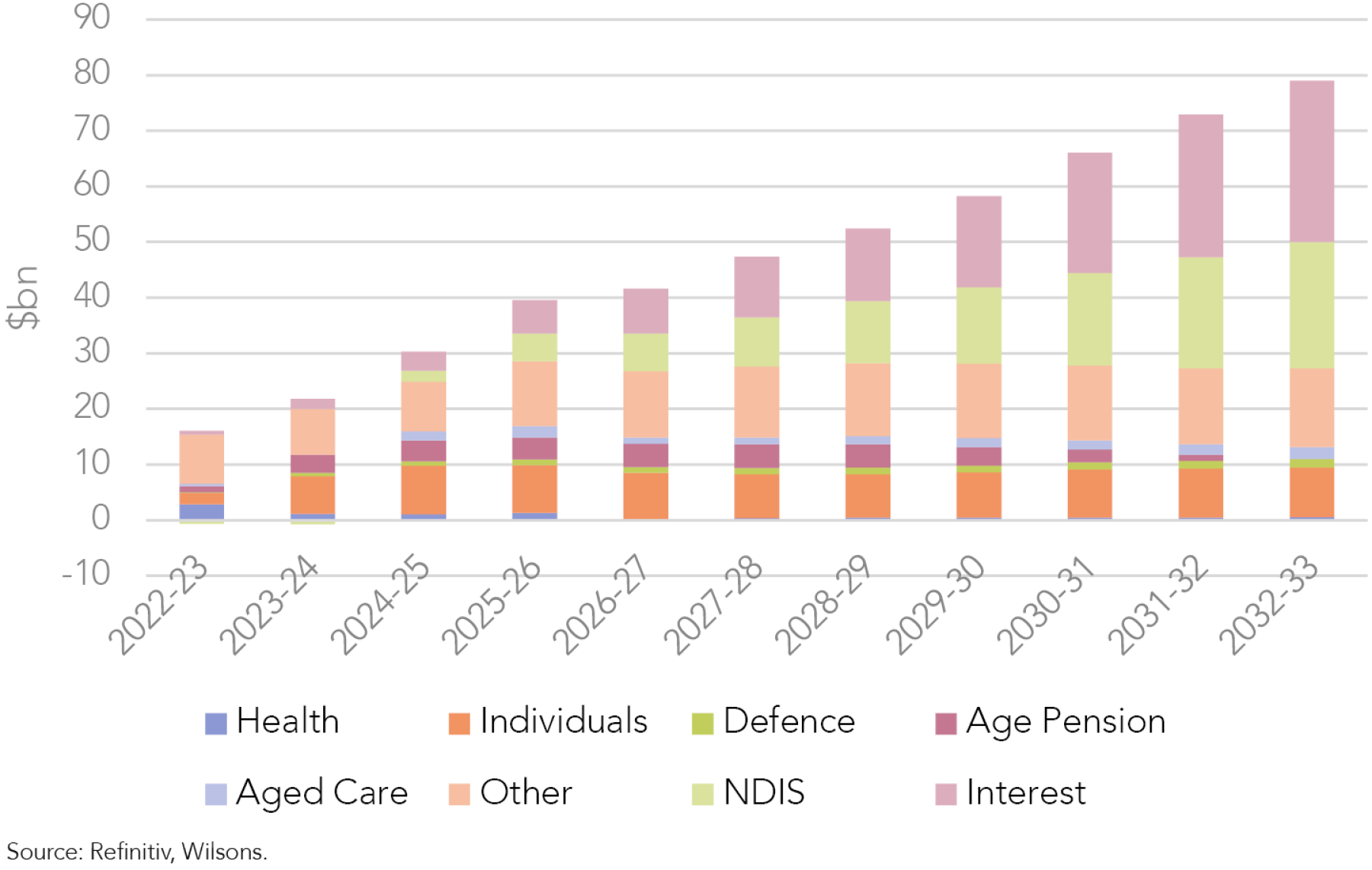

There appears to be 2 key reasons for the stubborn structural deficit

Firstly, interest payments on debt are forecast to be $76b over the 4-year forward estimate period and $70b per year by 2032-33, based on current government borrowing rates.

Secondly the NDIS which will cost $32b in FY23 and reach $50b a year by 2025-26. It is projected to grow at its current rate of 14% pa, costing $102b per year in a decade.

Defence, aged care and health are also applying structural pressure to the federal budget but interest payments and the NDIS are forecast to be the fastest growing structural imposts on the budget.

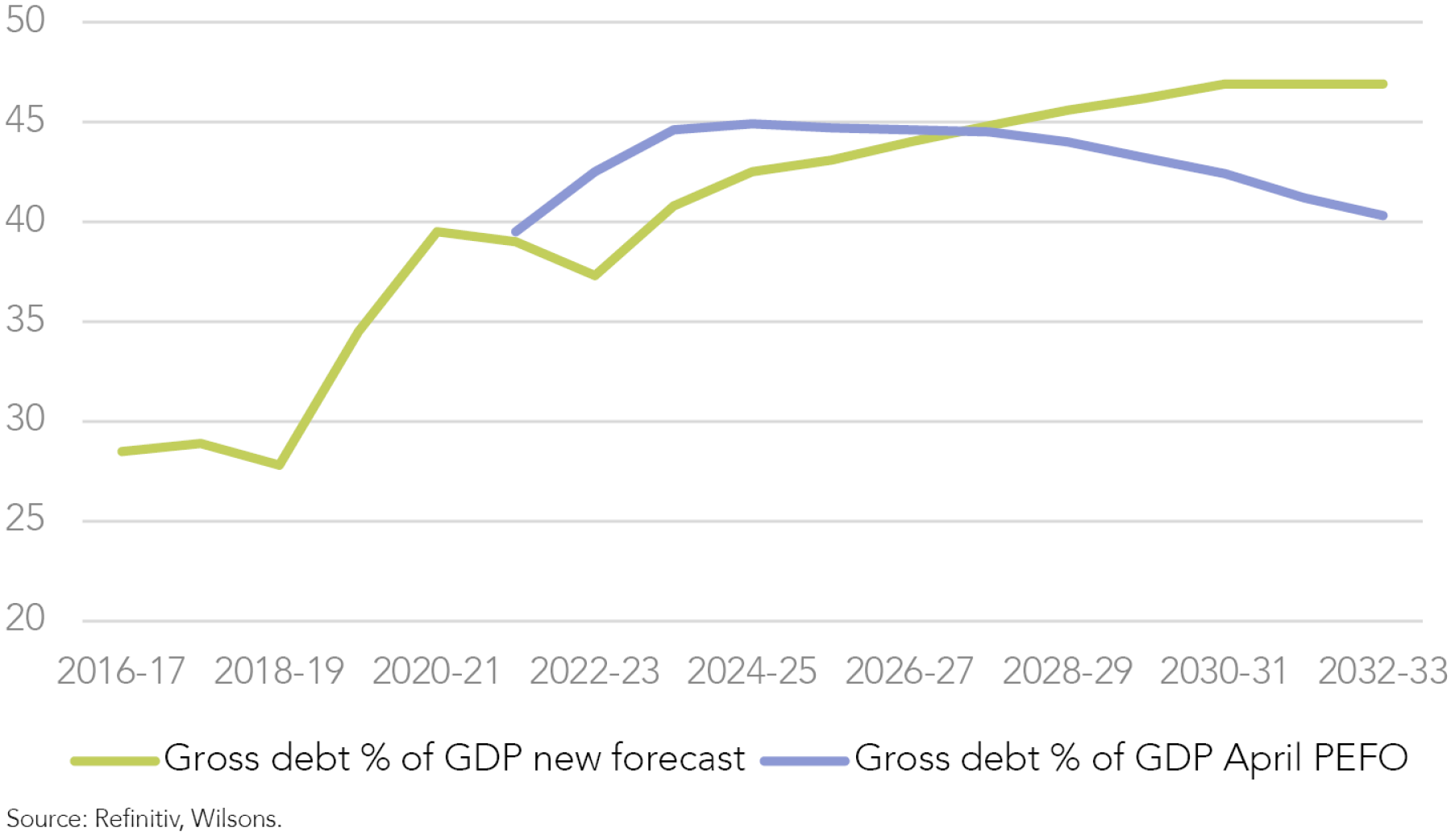

Gross debt as a proportion will track up to 46.9% of GDP by 2030 before stabilising. This is 6.7% higher than forecast in the April pre-election update. While this is concerning, we know Australia’s gross debt to GDP remains low in a global context.

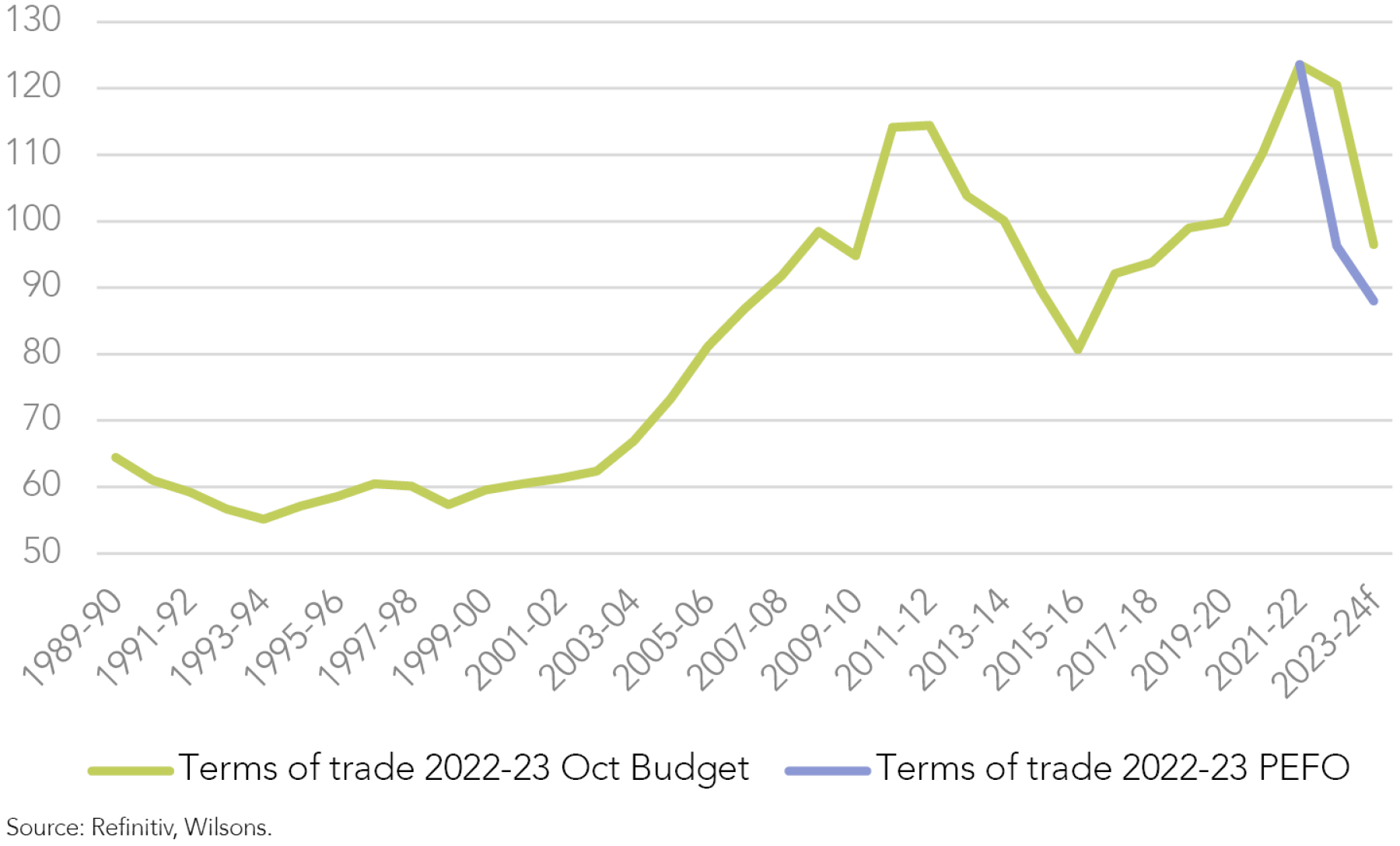

Commodity Revenue Windfall Could Extend Into FY23-24

On a potentially positive note, the budget papers assume the iron ore spot price will fall from US$91 per tonne to US$55 per tonne (FOB) by the end of the 2023 March quarter, the metallurgical coal spot price will decline from US$271 per tonne to US$130 per tonne and thermal coal will fall from US$438 per tonne to US$60 per tonne. These commodity price assumptions appear overly conservative at least on a near-term view and raises the possibility of yet another commodity windfall revenue gain by the time the next May 23 budget is announced.

Economic Projections Shift

Inflation expectations upgraded

Treasury forecasts inflation to reach 5.75% by mid-next year, outpacing the March budget projection of 3.0%.

Growth expectations have been lowered significantly

Treasury is now forecasting a more difficult outlook for the Australian economy. It expects growth will be weaker into 2023/24 with GDP falling to only 1.5% and expects unemployment will be higher by 75bps at 4.5%

| 2021-22 | 2002-23 | 2023-24 | 2024-25 | 2025-26 | ||||||

| PEFO | Budget | PEFO | Budget | PEFO | Budget | PEFO | Budget | PEFO | Budget | |

| Real GDP (% YoY) | 4.25 | 3.9 | 3.5 | 3.25 | 2.5 | 1.5 | 2.5 | 2.25 | 2.5 | 2.5 |

| Employment (% YoY) | 2.75 | 3.3 | 1.5 | 1.75 | 1.5 | 0.75 | 1 | 1 | 1 | 1.25 |

| Unemployment rate (%) | 4 | 3.8 | 3.75 | 3.75 | 3.75 | 4.5 | 3.75 | 4.5 | 4 | 4.25 |

| Consumer price index (% YoY) | 4.25 | 6.1 | 3 | 5.75 | 2.75 | 3.5 | 2.75 | 2.5 | 3.5 | 2.5 |

| Wage price index (%) | 2.75 | 2.6 | 3.25 | 3.75 | 3.25 | 3.75 | 3.5 | 3.25 | 2.5 | 3.5 |

| Nominal GDP (% YoY) | 10.75 | 11 | 0.5 | 8 | 3 | -1 | 5.25 | 4.25 | 5 | 5 |

*PEFO is April pre election forecast.

Source: Refinitiv, Wilsons.

Government Honours Pre-Election Cost of Living Promises

Cost of childcare and expanding parental leave

Addressing the cost of childcare and expanding parental leave are some of the largest commitments in this budget. The Government has also reiterated the importance of increasing female participation in the labour market.

Paid parental leave

Increasing gradually from 18 to 26 weeks by 2026. The first increase to 20 weeks is marked for 1 July 2023, providing families with more flexibility.

Parental leave eligibility

Households earning less than a combined $350,000 in income can access paid parental leave, expanding the eligibility criteria that previously depended on an individual income threshold ($150,000). Parents can now also take leave at the same time.

Cheaper childcare

The maximum subsidy rate will be raised to 90% from 85% for families earning less than $530,000 in household income.

Aged care reform

$2.5b allocated to improve the quality of aged care including an increase in wages for carers and to hire more nurses.Off-market Buyback Crackdown

The government is legislating against the practice of companies buying back their shares from shareholders off-market, at a discount to the market price. Companies have previously compensated investors for the price shortfall by streaming franking credits as a large portion of a dividend and capital return to shareholders. The strategy has allowed many investors such as low-taxed super funds to receive extra franked dividends and pay less capital gains tax on the return of capital. The government suggests a $550m saving over the first 3 years.

The measure is larger in revenue terms and separate to a crackdown on the use of capital raisings to fund the distribution of excess franking credits on the balance sheets of companies, which the government signalled before the budget. The latter measure is being consulted on by the Treasury and is expected to raise a relatively modest $10m per year.

With minimal incremental stimulus and few policy surprises, we don’t see it as providing a material boost for the equity market.

Sector-Specific Initiatives

Building materials and infrastructure-related businesses (CSR, BLD, JHX, ABC, SVW, DOW) should all benefit from the Government’s $120bn expenditure ($8b of new spending) on transport infrastructure and $350m on affordable housing.

The government has proposed a new Housing Accord with investors and representatives from the construction sector. The Accord sets an aspirational target of 1 million new, well-located homes over 5 years from mid-2024 as capacity constraints are expected to ease. Under the Accord, the Government will provide $350m over 5 years, with ongoing availability payments over the longer-term, to deliver an additional 10,000 affordable dwellings. States and territories will also support up to an additional 10,000 affordable homes, increasing the dwellings that can be delivered under the Accord to 20,000.

The Government is providing an incremental $8.1b to deliver on key infrastructure projects including the Suburban Rail Loop East in Melbourne, the Bruce Highway and other important freight highways such as the Tanami Road and Dukes Highway. These high priority projects are part of the more than $120b pipeline of investment in transport infrastructure over the next 10 years.

Labour-intensive businesses (CKF, WOW, COL, QAN, WES, CWY, PPE) are likely to be aided by increased skilled migration as it helps to ease worker shortages.

Childcare operators and landlords (GEM, CQE, HCW) may also to benefit from $4.7bn to increase subsidy rates to make childcare more affordable for families.

Rewiring the Nation will provide $20b of low-cost finance to make much needed upgrades to Australia’s electricity grid by building interconnectors and linking renewable energy zones to the existing grid at lowest cost. Modernising the grid will unlock new generation and storage capacity, help meet emissions reduction commitments and deliver cleaner, cheaper, more reliable energy for Australian households and businesses.

Strategic Tax Planning Insights

From a taxation perspective, the focus was on multinational tax integrity measures and tax compliance rather than the announcement of new tax measures.

Additional funding will be provided to the Australian Taxation Office (ATO) to extend the Personal Income Taxation Compliance Program ($80.3m for 2 years from 1 July 2023) and the Tax Avoidance Taskforce (around $200m annually over the next 4 years from 1 July 2022) and extend the Shadow Economy Program for a further 3 years.

The stage 3 tax cuts (see figure 8 below) which address bracket creep and reduce the amount of tax paid by individuals earning more than $45,000 are still slated to commence from 1 July 2024, however the Treasurer has left the door open to roll back these tax cuts.

Whilst there have been no changes to the taxation of discretionary trusts, corporate beneficiaries etc., clients (particularly complex family groups) need to ensure their structures are used in accordance with the legislation. With the additional funding, the ATO will be expanding its reviews of the taxation affairs of wealthy Australians.

| Current | From 1 July 2024 |

||

| Taxable income | Tax payable* |

Taxable income |

Tax payable* |

| $0 – $18,200 | Nil |

$0 – $18,200 |

Nil |

| $18,201 – $45,000 | 19% |

$18,201 – $45,000 |

19% |

| $45,001 – $120,000 | 32.50% |

$45,001 - $200,000 |

30% |

| $120,001 - $180,000 | 37% |

Income band removed |

|

| $180,001 + | 45% |

$200,001 + |

45% |

*Plus, Medicare Levy

Source: Refinitiv, Wilsons.

Superannuation

The eligibility for downsizer superannuation contributions has been expanded by reducing the minimum age from 60 to 55 with effect from the start of the first quarter after Royal Assent of the enabling legislation. Broadly, this legislation allows a couple to contribute up to $300,000 each to a complying superannuation fund regardless of their superannuation balance on selling their family home (subject to meeting specific conditions). The legislation for this change is currently before parliament and expected to pass this financial year. Please contact your advisor for more information to determine if this valuable contribution applies to you.

The start date for the previously announced relaxation of the residency requirements for self-managed superannuation funds has been deferred to the start of the income year after the date of Royal Assent of the enabling legislation. These measures propose to relax the current self-managed superannuation fund (SMSF) residency rules through an extension of the central management and control safe harbour test to 5 years and removing the active member test which unfairly restricts contributions being made to SMSFs when members are overseas. However, a departing SMSF trustee still needs to establish, prior to leaving Australia, that the planned period of leave is temporary.

The Budget has ruled out the controversial idea proposed by the previous Government to replace annual SMSF audits with a 3-yearly cycle. Given the importance of annual audits in the administration of the ATOs compliance function, many SMSF professionals were mystified as to why this was ever announced.

There was no announcement on:

- Extending the 50% reduction of the minimum pension payments required under the superannuation legislation. The current reduction will therefore cease on 30 June 2023; or

- The 2-year amnesty relating to the commutation of certain legacy pensions (e.g. market-linked, life-expectancy and lifetime pensions).

Low emission vehicles

From 1 July 2022, battery, hydrogen fuel cell and plug-in hybrid electric cars will be exempt from Fringe Benefits Tax and import tariffs if the vehicle has a first retail price below the luxury car limit for fuel efficient cars (currently $84,916). This provides an opportunity for business owners and employers to provide fuel efficient cars to family members or employees. Related expenses can be paid out of pre-tax income, however further clarification is still required in certain circumstances (e.g. if a $15,000 battery needs to be replaced). The Bill was introduced to the House of Representatives in July this year.

Digital currencies

Legislation will be introduced to exclude digital currency (e.g. Bitcoin, Ethereum etc.) from the Australian foreign currency rules. Broadly speaking, gains or losses on foreign currency held or foreign denominated loans are treated as assessable income or deductible losses without the benefit of the 50% capital gains tax discount. However, digital currencies issued by or under authority of a Government agency will continue to be taxed as foreign currency.

Other measures

The Budget has given no indication as to whether the Government wishes to proceed with the previously announced changes to the residency rules for individuals (45-day rule) and companies, and reform to Division 7A (provisions relating to loans made by private companies to shareholders or associates).

The income threshold for the Commonwealth Seniors Health Card will be increased from $61,284 to $90,000 for singles and from $98,054 to $144,000 (combined) for couples.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons: Wilsons is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons contains a financial product advice, it is general advice only and has been prepared by Wilsons without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons’ Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons’ disclosures at www.wilsonsadvisory.com.au/disclosures.